It is crucial to compare Medigap plans when you are first turning 65 or going on Medicare for the first time. So, how exactly do you do that?

First and foremost, you should understand that the words “Medicare Supplement” and Medigap plans are interchangeable and have exactly the same meaning. Each Medigap policy must follow the federal and state guidelines designed to protect the consumer and must clearly be identified as “Medicare Supplement Insurance.” Each plan has the same benefits regardless of which state you live in or which insurance company you buy it from. This is why it is vital to compare Medigap plans to make sure you get the best “deal” for the plan that you want.

NOTE: If you live in Massachusetts, Minnesota or Wisconsin, the Medigap plans in these states are standardized differently.

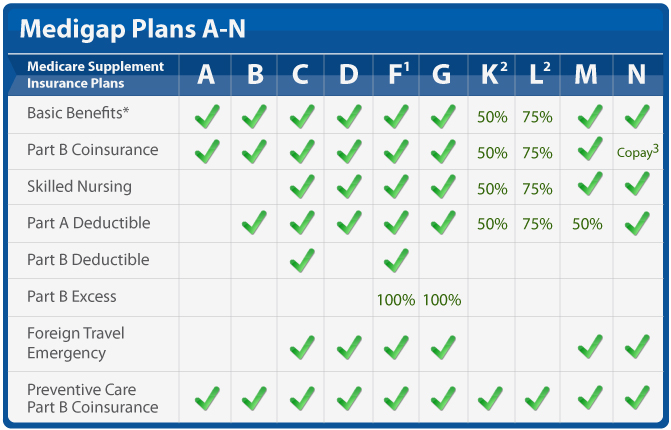

Standardization enables the consumer to easily compare the benefits and costs of the different insurance companies offering the plans. There are 10 Modernized Standardized Medicare Supplement plans “A” through “D”, “F” and “G”, and “K” through “N”. All plans are required to cover the same basic benefits, although some are able to offer additional benefits to meet your needs. Plan F, also offers a high-deductible plan in some states, which means that you must pay for coinsurance, copayments and deductibles up to $2,200 in 2017. Once you meet those requirements, your policy will pay the rest. Plan N pays 100% of the Part B coinsurance, but has a copayment of up to $20 for office visits and up to $50 for emergency room visits. If the E.R. visit results in an inpatient stay, that copay is waived.

Medicare standardized the plans in 1990 to limit the consumer’s confusion when comparing coverage offered by different insurance companies. However beginning June 1, 2010 the plan chart and benefits were modified and improved to meet the changing health care environment. Some benefits were eliminated and several benefits were added to enhance the Medicare Supplement coverage.

How to Compare Medigap Plans Using the Medigap Coverage Chart

- If a check mark appears in the column, this means that the Medigap policy covers the benefit up to 100% of the Medicare-approved amount. What is the Medicare-approved amount? In Original Medicare, this is the amount a doctor or supplier who accepts payment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays a portion of this amount and you are responsible for the difference.

- If a nothing is in the column, the benefit is not covered by the plan. If a column lists a percentage, this means the policy covers the benefit at a percentage rate of the Medicare-approved amount. If no percentage appears or if the column has a dash, this means the Medigap policy doesn’t cover the benefit. Note: The coverage of coinsurance only begins after you have paid the deductible on plans K & L.

What are the advantages of using an independent broker:

First, not all insurance companies publish their rates to the public. That’s where the independent broker steps in to help you compare Medigap plans. There are many advantages to using an independent Medigap broker. He or she is very knowledgeable about chart standardization, is familiar with many insurance companies, and represents a spectrum of companies. They will be able to give you their unbiased, independent opinion. This can in the long run, save you money!

You can, of course, compare Medigap plans on your own and enroll in a Medigap policy directly with the insurance company. You will still get the same rate, same benefits, same claims processing, etc. However, there are many advantages to using an independent broker:

- Most insurance companies have call centers and their employees are not as well-versed as far as the in-depth knowledge necessary to sell or service the products they are dealing with. Whereas an independent broker is specialized in this type of market; therefore he or she has more expertise in all the facets of the benefits, and how the plan works, so that you may choose the right plan for you. He or she is qualified to answer each and every question you might have.

- An independent broker has the ability to research, compare and compile all your options using his experience and knowhow in navigating this market. Insurance company websites may not be updated, or as mentioned above, all rates may not be published and available to the public. The average consumer might spend hours gathering information and then not know where to start to decipher all that! The independent broker is adept at doing this.

- An independent broker can also provide virtually unlimited and unbiased expertise from their dealings with the various Medigap plans. For us, we represent 30+ companies in 40+ states, so we have clients with many different companies. We have seen how stable companies rates have been over time, what problems/issues clients have had and which companies have maintained a strong position in the marketplace.

- Once you do decide which plan is right for you, the independent broker handles the application process from beginning to end. Even when your Medigap policy is approved and in force, he/she is there to assist you with any concerns or questions you might have. The independent broker’s goal is to deliver concierge level service.

- Lastly, another advantage of using an independent broker is that insurance companies incorporate the brokers’ commission into their rates. If you are paying for them anyway, why not take advantage of their expert, free, unbiased advice?

To summarize, it can be a daunting task for seniors to choose the right Medicare Supplement insurance plan for them. Compiling, researching, comparing, and deciding are just some of the things they need to do. It is very time consuming, not to mention exhausting. Our role as an independent broker alleviates this burden for them. If you have questions about this or how using an independent Medigap broker works, please contact us at 877.506.3378 or on our website, www.65medicare.org.