As debate rages on in Congress about reforming, repealing, replacing, and/or repairing the Affordable Care Act, there are no easy solutions, and frankly, there’s not much hope for a reasonable and lasting outcome. With that current environment in mind, we would put forth the idea that there IS a successful health insurance model out there that lawmakers should look to when crafting legislation to change our health care system.

As debate rages on in Congress about reforming, repealing, replacing, and/or repairing the Affordable Care Act, there are no easy solutions, and frankly, there’s not much hope for a reasonable and lasting outcome. With that current environment in mind, we would put forth the idea that there IS a successful health insurance model out there that lawmakers should look to when crafting legislation to change our health care system.

It’s not the much-discussed single-payer solution. On the contrary, it’s a private insurance program, available to those on traditional Medicare, called Medigap. Medigap plans are plans that fill in the “gaps” in traditional Medicare, helping consumers pay for the deductibles, copayments and coinsurance that are not covered by Medicare. Medigap has a stable history and many characteristics that could carryover into health care reform.

Simplicity of Plan Choices: Standardization

The first and foremost characteristic of Medigap plans is Federal standardization. In all but a few states, the plans are Federally-standardized, meaning that insurance companies that offer the plans have to offer plan designs set forth by the Federal government.

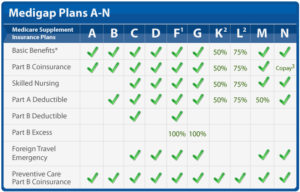

These plans go by letters and are very easy to understand and use. The Medigap coverage chart shows all the plans. Shoppers can choose the level of coverage that they want, then proceed with comparing rates and companies to make a selection that is appropriate to their level or need and financial means.

With Medigap, there are 20-30 companies offering plans in most states, and insureds can choose the level of coverage they want, then compare rates and company reputations – either on their own or through an independent agent. The level of competition in the Medigap market – with so many companies offering plans – has also contributed to keeping rates low over time.

Adding this level of simplicity to health care reform would, undoubtedly, strengthen the level of buy-in and make comparing plans immensely more straight-forward and easy to accomplish.

Initial Open Enrollment Period

Medigap plans offer a one-time 6-month open enrollment period when you first turn 65 or start on Medicare Part B. During this time, you are allowed to choose a Medigap policy with no underwriting and no exclusions based on pre-existing conditions. This period ensures those with health problems have a chance to get on a plan without the possibility of rejection by the insurance company.

It offers an incentive to being covered and purchasing the coverage one wants/needs when available. After all, insurance should be just that – insurance against potential future loss (in this case, potential future illness or injury), not an opportunity to cover yourself right before you need it.

The initial open enrollment window would “reward” people for being forward-thinking and making smart financial decisions instead of punishing all stakeholders with higher rates because people are naturally more inclined to only get insurance when they “need it”, if given that opportunity.

Underwriting Outside of Open Enrollment

On the other hand, this initial open enrollment window also introduces the idea of a “penalty” of sorts if you don’t elect to get a Medigap during your initial open enrollment period. Outside of the open enrollment period, you typically have to “qualify medically” to obtain a Medigap plan.

While allowing everyone to be covered whenever they want to be would be great, it’s not a viable solution in theory. Insurance companies cannot be expected to take on the claims of the sickest of the sick that choose to only get insurance at the time that they need it.

Moreover, unless they are made to it, many insurance companies simply aren’t willing to play on that playing field. You need to look no further to the reductions in options in many states, as insurance companies have pulled out of offering individual health plans altogether.

In the Medigap market, the use of an initial open enrollment period and underwriting outside of that period has led to stability over time. Compared to the individual health insurance market, particularly since 2014, Medigap rate increases have been particularly stable with the national averages coming in around 5-8%.

No Government Subsidies

All of the success in the Medigap market has been accomplished without any government involvement or oversight, with the exception of setting the standardized plans chart. The insurance companies receive no subsidies for offering Medigap plans or paying claims, and Medicare consumers receive no subsidies for purchasing a plan.

There is not a need for them, as sensible standardization and underwriting have insured that rates stay stable and companies can successfully offer them.

Does Medigap Work Everywhere?

In most parts of the country, these characteristics of Medigap plans have allowed there to be lots of choices (competition) and stable rates.

However, states do set their own rules regarding some aspects of Medigap. Not surprisingly, there are a few states that have “adjusted” the normal Medigap rules to allow for “guaranteed issue” to all buyers at any time – NY and MA, for example. In those states, rates are typically double (or more) the rates in most other states and there are very few insurance companies participating in offering Medigap plans. Sound familiar?

In states where the actual free market is allowed to work, however, people who follow the clearly set-forth rules about when to buy a plan are rewarded by having excellent coverage for a reasonable price. Most studies have shown that over 90%+ of people are happy with their Medigap coverage. Premiums for Medigap are generally in the $100-150/month range, depending on where you live and your age.

So, what about the people who simply cannot afford Medigap? There are certainly some people for whom Medigap is not an option for financial reasons. There are other options, however, including Medicare Advantage, which has considerably lower premiums, or staying with traditional Medicare. Likewise, health care reform could easily put into place other options for people who could not or did not purchase “traditional” health insurance.

Overall, discussion of health care reform will continue to be at the forefront of the national discussion. There is a viable model available for study in Medigap plans – they’ve stood the test of time and continue to be a reasonable and successful (for policyholders AND insurance companies) option for those on Medicare. We should stop punishing everyone with high rates and few choices and move towards a system that rewards those people that make sensible and prudent financial choices.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.