How’s the saying go? Dea th and taxes. Well, today’s the day – tax day. Surely you haven’t waited until the very last day to file your taxes! A recent study showed that 12+ million taxpayers file for extensions each year, so maybe you haven’t filed yet after all. If not, and if you are cruising the Internet instead of working on them, we have the answer to an oft-asked question – are Medigap premiums tax-deductible?

th and taxes. Well, today’s the day – tax day. Surely you haven’t waited until the very last day to file your taxes! A recent study showed that 12+ million taxpayers file for extensions each year, so maybe you haven’t filed yet after all. If not, and if you are cruising the Internet instead of working on them, we have the answer to an oft-asked question – are Medigap premiums tax-deductible?

The short answer to this question is “Yes, Medigap premiums are tax-deductible”. Medigap premiums are treated as a normal medical expense and are treated under the same guidelines as any other type of expense in this category.

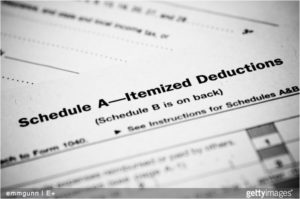

The stipulation on their deductibility, though, is that the taxpayer must be itemizing deductions to get the deduction on Medigap premiums. This is also the case with any other type of medical expenses. Additionally, not all expenses are tax-deductible under medical expenses – only the portion that surpasses 7.5% of the taxpayer’s adjusted gross income (AGI).

How To Deduct Medigap Premiums on Taxes

So, we’ve established that Medigap premiums are, in fact, deductible. How do you go about deducting them?

Very easy to do – you include them on Schedule A, Itemized Deductions for Form 1040, as itemized medical expenses. Again, you must be itemizing deductions in order to get a benefit from this deduction.

In an example, let’s say your AGI is $30,000. From that number, 7.5% is $2,250. If your itemized deductions are $4,000, then you have deductible expenses of $1,750. Using these number, if your medical expenses did not exceed $2,250, you would not be able to itemize and deduct medical expenses.

What Other Medicare-Related Expenses are Tax-Deductible

Besides Medigap premium, there are many other Medicare-related expenses that can be tax-deductible. Often, Medicare beneficiaries are not aware of all of these and/or do not take advantage of them.

Generally, the IRS says that allowable medical expenses that can be included on the itemized deductions are any expenses incurred for diagnosis or treatment of an injury or illness, including medical equipment, supplies and preventive care. It also includes some categories that you may not expect, including transportation costs to and from doctor visits and the costs associated with altering your home for medical reasons (i.e. installing a ramp for medically necessary reason).

As always, it is wise to consult with a CPA before making a decision on what is/is not deductible, but here is a partial list of other tax-deductible medical expenses that may apply to someone on Medicare:

- Cost of Medigap premiums

- Cost of Medicare Part B (most people pay out of Social Security)

- Cost of Medicare Part A (most people don’t pay a premium for Part A)

- Cost of Medicare private health plans (Medicare Advantage)

- Cost of Medicare Part D plans (Rx coverage, often comes directly out of Social Security)

- The amount you pay out of pocket for co-pays, deductibles and coinsurance for Part A, B or D services

- The amount you pay for things that Medicare does not normally cover – i.e. hearing aids, eyeglasses, contact lenses, dental care, nursing home care

- Premiums for long-term care insurance (in some cases)

A few Medicare-related expenses that you cannot deduct are:

- Nonprescription drugs/vitamins/supplements unless specifically recommended by a physician to treat a specific condition (and documented)

- Late penalties on Medicare Part B or D (often added in with your regular premiums so have to be careful to separate the two)

- Premiums for group health insurance (when paid with pretax dollars)

- Prescription drugs bought overseas or online coming from overseas

- Payments that were made by an insurance company to a medical provider

The question, “are Medigap premiums tax-deductible?” is something many people don’t have an answer for. With the lower AGI’s often seen in retirement, it can definitely make sense to itemize your medical expenses deductions. In many situations, you can reduce your tax burden by doing so and save yourself some money.

There are, of course, many other ways to save money for people on Medicare, many of which are detailed on our site, 65Medicare.org. If you have any questions or want to speak with someone directly, you can reach us online or at 877.506.3378.