65Medicare.org is a Medigap broker. We help people understand Medicare, compare Medigap plans on the basis of coverage, costs, and reputation. And ultimately, we help people to sign up for the Medigap plan that fits their needs. As a Medigap broker, we can compare all of the options in a centralized place and make an informed, no-pressure choice.

Whether you use us or another broker, it is highly advisable to use a Medigap broker when you make your Medigap selection. There are a handful of reasons for this – we’ve listed the top 7 reasons to use a Medigap broker below:

1. You can compare all the Medigap options in a centralized place.

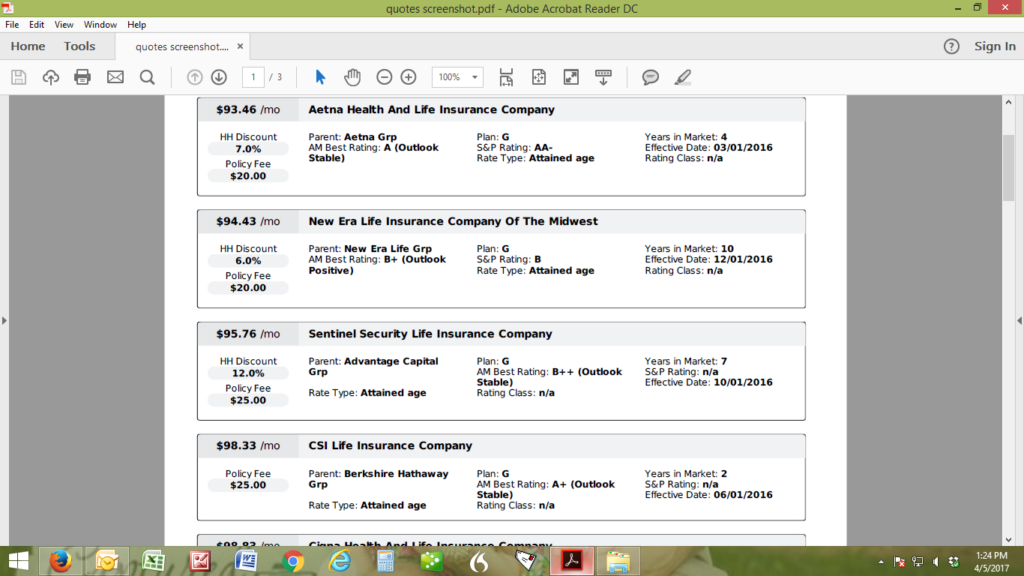

There are 30+ Medigap companies offering in most states. The alternative to using a broker, if you want to make any kind of educated decision, is to call each one of them. Even if you are retired with nothing but time on your hands, talking to insurance agents from 30+ insurance companies, each touting their own plans, may not sound like your idea of a good time.

A Medigap broker can provide a full list of the plans available in your area and help you compare them on the basis of price, company ratings and reputation and future outlook. This way, you can make an informed, no pressure choice.

2. Your Medigap agent/broker has a loyalty to you and your satisfaction, not to one specific insurance company.

Medigap brokers get paid when you sign up for a plan. They do not care whether it is Company X or Company Y paying them. Their loyalty is to the insured, to make sure that you are happy and satisfied with whatever plan you choose. If you are not, any decent Medigap broker will switch you to a company/plan that you ARE happy with. You are still their client, either way. This is, obviously, not the case if you are dealing directly with one insurance company.

whatever plan you choose. If you are not, any decent Medigap broker will switch you to a company/plan that you ARE happy with. You are still their client, either way. This is, obviously, not the case if you are dealing directly with one insurance company.

Where should we email the list of plans? Get a List of Plans for your Area from a Medigap Broker

3. You have a direct representative that you can call if you ever have problems or questions.

There are, frankly, very, very few “issues” with Medigap plans. The problems that are there are usually due to provider oversight or some other easily correctable issue. That said, when there are problems, your options are calling an 800 number to an overseas call room where the representative is not financially incentivized to handle your problem OR calling YOUR broker who knows who you are and IS financially incentivized to solve your problem.

4. Medigap brokers can do the majority of the enrollment work for you.

Have you seen the application for a Medigap plan? The applications for most companies are 10-15 pages long and written in 8 point font (not sure why Medigap insurance companies have not figured out who their market is). A Medigap broker will help you complete the application, and with most companies, it can even be done over the phone with minimal hassle and time spent by you.

companies have not figured out who their market is). A Medigap broker will help you complete the application, and with most companies, it can even be done over the phone with minimal hassle and time spent by you.

5. Brokers can add other valuable services, such as annual Part D reviews.

Medigap brokers, again, are paid to keep you as their client. Most, including 65Medicare.org, offer additional services to clients. Some of these services that we (and many other brokers) offer include: an annual review of your Medigap plan, annual Part D reviews, quarterly email newsletters, important updates about changes to Medigap and Medicare and regular availability for problems or questions.

6. You are paying for it already, whether you use one or not.

Our favorite question is ‘how much does it cost to use you to sign me up for a plan?’ So glad you asked! The answer is $0 – yes, $0. Not much is free these days, but using a Medigap broker is. Well, not exactly – you see, the commissions that brokers are paid is built into your premiums already. In other words, you are paying for a broker, whether you use one or not. You get the same Medigap premium rate, whether you have a broker and his or her services or whether you do not have one.

7. Medigap brokers are financially incentivized to make sure you like your Medigap plan.

Last but not least, Medigap brokers get paid every time that you pay your premium to the insurance company. So, they are financially incentivized to ensure that you like your plan and are happy. Contrast this to a sales agent for insurance company X, who has a quota to meet and is paid a one-time bonus for “selling” you. Which one do you think has your interests more in mind?

THE BOTTOM LINE

Whether you use 65Medicare.org as your Medigap broker or someone else, it is a good idea to use one and have one. If you have not done so in the past, it’s not too late. If you are turning 65, it’s a good idea to establish a rapport with one broker so they can understand what your needs, resources and concerns are, thereby allowing them to make better recommendations.

If you want to work with us, let us know here: Work with 65Medicare.org to Compare and Choose a Medigap Plan.

Hello Guys:

I’m starting medicare on April 1, 2022 and I would like help in selecting a plan “N” medigap provider and a part D drug plan. Please reply asap if you can assist.

Hi Michael, Sure thing – I replied by email to you just now. We will wait to hear from you so that I can provide the list of ‘N’ options and recommendations.