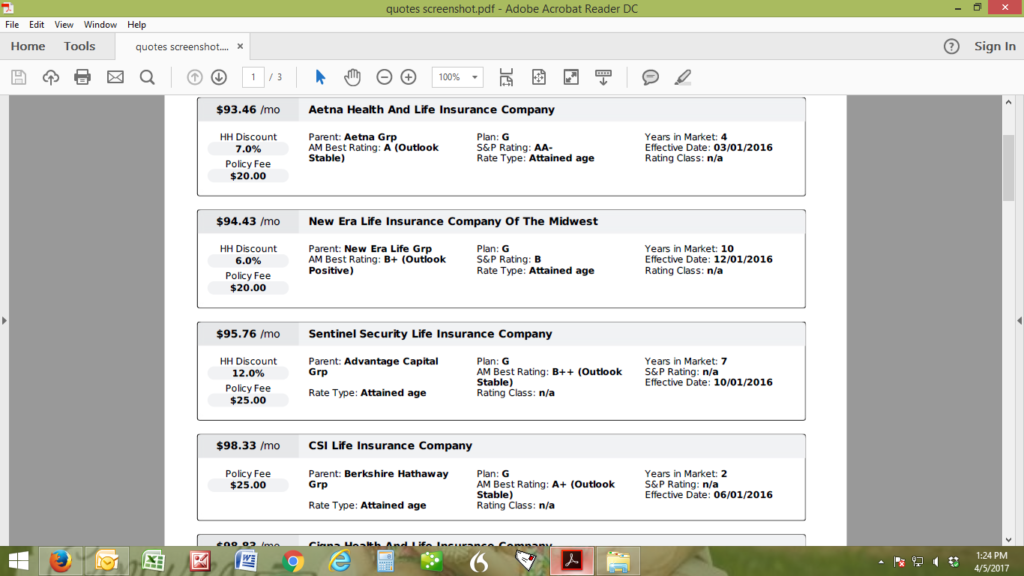

You might have heard the terms attained-age, issue-age, and community rated, when doing your research on which type of Medigap policy to buy. These are the three methodologies for rating the Medigap policies that various insurance carriers offer.

It is important to note that, while you can certainly select a preferred rating methodology to sign up for, there is no guarantee that plans using this methodology are available in your state. In some states, all the plans use a certain rating system by law. In many states, there are only one or two very high priced options for community rated and issue-age rated plans. Nationally, attained-age rated policies comprise, by far, the majority of policies that are offered.

We’ve clarified the nuances of each of these three rating methodologies below:

Community Rated Medigap Policies

These are probably the easiest to comprehend of all three plans. They may also be known as “no age-rated” plans. Everyone is grouped together, no matter what your age, gender, or health condition. In other words, you are charged the same premium as other people living in your area regardless of your age, whether you are a male or female, or whether you are in good health or not.

This type of rating may be advantageous for someone living in expensive areas as opposed to those living in rural areas. It also may be beneficial for males versus females, since male Medigap premiums tend to be higher than their counterparts. In addition, in some larger states, as Pennsylvania or Texas, community rates may differ depending on which part of the state you are in. These plans can be less expensive over time, even when taking inflation and other factors into consideration. However, they do still go up – each year in most cases – based on inflation, changes to Medicare and other factors.

Issue-Age Rated Medigap Policies

This rating class is also known as “entry age-rated.” The premium depends on your age at the time of your application (when it is issued). For example, John is 75 and purchases Medigap policy with a premium of $187 per month. Judy buys a policy when she is 69 years old and pays $148 per month. John’s plan costs more because he is older when he buys it. This premium will not increase based on your age, but it will be affected by inflation and other factors, causing an increase in rates. In most cases, this is something that happens annually.

Attained-age rated

This rating classes bases your premium on your “attained” age, the age you currently are when you buy the policy. Attained-age-rated policies generally are cheaper at age 65, but their prices increase automatically as you age. The following will illustrate a situation in which attained-age rating is used:

Jim Bailey is currently 67 years old and buys a Medigap policy, with a premium of $125. When he turns 68 years old, his premium will increase to $128. At 72, he will pay $142.

Other Considerations

Again, please note that in certain states, insurance companies are required by law to sell “issue-age” policies only. Georgia and Florida are examples of this. As a result, rates are generally higher but possibly more stable in the long run.

Also, you should always be aware of other variables that impact the rates. Some companies have gone to using a discount for signing up at age 65; however, the discount goes away each year as you get older. Although they may technically be able to classify themselves as community-rated, the premium has a built-in increase each year as you get older because of the expiration of the discount. This makes a policy like this no different from an attained-age policy for the life of the discount.

Which Rating Methodology for Medigap Policies is Best?

This should have given you a better understanding of how insurance companies rate their Medigap pol icies. Hopefully, with this knowledge you will be able to make an informed decision when it comes time for you to choose a Medigap plan.

icies. Hopefully, with this knowledge you will be able to make an informed decision when it comes time for you to choose a Medigap plan.

The bottom line is that the best Medigap plan is the one that gives you the best “deal” for the life of the policy at a coverage level you want. All the above types of rating classes have historically resulted in increases over time to account for inflation. There are unfortunately no guarantees as to the amount of each increase. Your best protection against any future rate increases is to select a company that has stability, an excellent reputation (is highly rated) and of course, the cost of the policy.

If you want a list of Medigap plans for your area or have specific questions, you can contact us online or call us at 877.506.3378.

[…] Attained-age rated Medigap policies are, by far, the most common among the three. In some geographic areas, these are the only types of policies even offered, at least on certain plans. […]