Let’s face it – Medicare can be confusing. There’s a lot of information out there, and not all of it is accurate or well-intentioned. Most people have tons of Medicare questions when they are signing up for Medicare or turning 65.

Signing up for Medicare is daunting enough, but what about all the years that follow? There are an unlimited number of Medicare questions that Medicare recipients come up with after they have made their decisions. Whether they chose Original Medicare, or a Medicare Advantage Plan (including a Prescription Drug Plan), or Original Medicare plus a Medicare Supplement (Medigap) plan, there may be unanswered questions from when they first enrolled, or questions that may have arisen afterwards. We have put together a list of the most frequently asked questions among this segment of the population, in hopes that clarity may be gotten from this information.

If I enrolled in a Medigap plan, do I need to renew it every year?

No, you do not have to renew it again. It is “guaranteed renewable”, which means you cannot be terminated from the plan for any reason, including any new health conditions you have developed.

Does a Medigap plan include prescription drugs?

No, it does not. You will have to get a stand-alone drug plan besides the Medigap plan.

When can I disenroll in or switch from one Medicare Advantage plan to another?

You can switch or drop your Medicare Advantage plan, but only during certain periods of the year:

- The annual open enrollment each year from Oct. 15 – Dec. 7. However, your new plan will not become effective until Jan. 1st of the following year.

- The Medicare Advantage Disenrollment Period, Jan. 1 – March 31, each year.

- The Special Enrollment Period – there are certain circumstances which will allow you to change, i.e. moving out of the service area of your plan; you decide to switch during the first year you joined a Medicare Advantage plan (trial period).

I’m planning to retire, what will happen when my employer coverage ends?

When your employer coverage ends, you have 8 months within which to enroll in Part B (or choose COBRA). You will need to complete an Application for Enrollment in Part B (CMS-40B) and a Request for Employment Information (CMS-L564). Even if you choose COBRA, be aware that if you do not enroll in Part B during the 8-month period following your termination of coverage, the following may occur:

- You may incur a penalty for the duration that you have Part B.

- You will not be able to enroll until January 1–March 31. If that happens, you will then have to wait until July 1 of that year before your coverage starts.

Are pre-existing conditions immediately covered, or is there a waiting period?

Original Medicare and Medicare Advantage plans do not generally take into consideration pre-existing conditions or disabilities. However, if you have end-stage renal disease (ESRD) or want to enroll in a Medicare Supplement (Medigap) plan, there are some exceptions. It is the insurance company who determines what their guidelines are and which, if any, pre-existing conditions they want to include. Each company also decides on the length of the waiting period if any.

The exception to this is if you apply for a Medigap plan during the open enrollment period when you first turn 65 or start on Medicare. During this time period, there are no health questions, no pre-existing conditions, and you are automatically approved.

If I apply for a Medigap plan, will I be immediately approved?

Unless you are in “open enrollment” or are entitled to be a guaranteed issue, then no. Your application will have to go through medical underwriting and you will be obligated to answer medical questions. This is why it is important to choose a Medigap plan when you are first eligible for Medicare if you intend to get one at any point.

How often can I change my Part D, Prescription Drug Plan?

You can switch your PDP during the annual open enrollment period, Oct. 15 to Dec. 7, each year. Otherwise, there are certain circumstances which would allow you to change, i.e. you moved out of your plan’s service area; your plan was dropped from being offered in your service area. If you are eligible for Extra Help, you can change your PDP at any time during the year. You can also change at any time if switching to a 5-star rated prescription drug plan.

What is IRMAA and why do I have to pay it?

IRMAA stands for Income Related Monthly Adjustment Amount. It is an additional amount which is added to your premium. If your modified adjusted gross income is above a certain amount (according to your IRS tax return from 2 years ago), you will pay the standard premium amount ($135.50), plus an Income Related Monthly Adjustment Amount. To learn more, please go to https://www.medicare.gov/your-medicare-costs/part-b-costs.

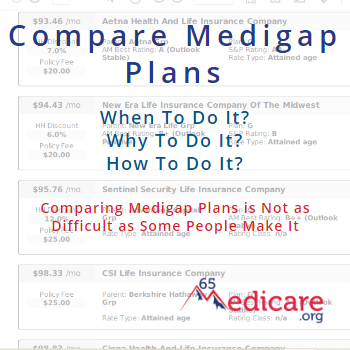

What are the rating methods used to set the rates for Medigap plans?

Attained-age rates are determined by your age when you are on the policy. They go up as you get older. Issue-age policy rates are determined by your age at the time the policy is issued. Community-rated policies charge the same rates to everyone within the same geographic area.

What should I do if my Medigap premium goes up?

Medigap premiums, just like any other type of insurance, do go up over time. The premiums are typically determined by your age, so they will typically increase as you get older. Additionally, rates change as Medicare makes changes to the coverage offered by traditional Medicare, since Medigap plans automatically “expand” to cover Medicare gaps.

If and when your premium increases, it is a good idea to “shop” to ensure that you have the best available deal. If you are in good health, you can very easily change to equivalent coverage from a different company, potentially saving yourself money for equal coverage.

Other Medicare Questions?

You probably have Medicare questions that are not covered by this brief list. We have answers. If you have a question about Medicare itself, Medigap or Medicare Advantage or Part D, please feel free to contact us.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

Leave a Reply

You must be logged in to post a comment.