The time that you sign up for Medicare is one of the largest insurance-related transitions that  happens in one’s life. However, it is not always easy to understand the steps that you need to take or process you need to follow to sign up for Medicare.

happens in one’s life. However, it is not always easy to understand the steps that you need to take or process you need to follow to sign up for Medicare.

By necessity, because they have to cover so many different situations, the Medicare-published guides are hundreds of pages thick, and many people don’t take the time to read them or understand them. This one-page guide is intended to simplify that process and answer any questions that you have about how and when to sign up for Medicare.

We’ll go through the five most common scenarios and what is needed to sign up for Medicare in each one of them:

Scenario #1: You are turning 65, are already receiving Social Security, and want to sign up for Medicare.

This is the most common situation; fortunately, it is also the easiest as far as signing up for Medicare. If you are already receiving Social Security, as long as you have qualified for Medicare through your employment or your spouse’s employment (i.e. you’ve paid for it through payroll taxes for 40 quarters), you will be AUTOMATICALLY enrolled into Medicare Part A and Medicare Part B.

Your Medicare will begin the first day of the month that you turn 65. If your birthday falls on the first day of a month, you will get Medicare on the first day of the preceding month. There is nothing you need to do to enroll in Medicare. You will receive a red, white and blue Medicare card by mail approximately 3 months before your 65th birthday (NEW Medicare cards – what you need to know).

You will begin paying your Medicare Part B premium (there is no premium for Medicare Part A) beginning in the month that your Medicare starts. This payment occurs automatically out of your Social Security check. The premium for Part B for 2024 is $174.70/month unless you fall into a higher-income bracket and are required to pay Medicare IRMAA.

Scenario #2: You are turning 65 and are NOT receiving (and plan to delay) Social Security, but you want to sign up for Medicare.

This is an increasingly-common scenario as more people are choosing to delay their Social Security. In this case, there are actions that you must take to enroll in Medicare, if you wish to have Medicare start at age 65.

You will still be automatically enrolled into Medicare Part A (premium-free). However, Medicare does not assume that you want Medicare Part B if you are not receiving Social Security. You will still receive a Medicare card automatically about 3 months before you turn 65; however, the card will only reflect Medicare Part A. You will need to proactively sign up for Medicare Part B.

sign up for Medicare Part B.

To do this, you can go on Social Security’s website to apply for Medicare online OR you can visit a local Social Security office to enroll in Medicare without taking Social Security benefits. This should be done 2-3 months before your Medicare start date, which will be the 1st day of the month that you turn 65.

Scenario #3: You are already over age 65, but you were covered by other insurance when you turned 65. You now want to sign up for Medicare.

As many people work longer, they are being covered by group insurance plans and wish to delay when they sign up for Medicare. This is certainly an option and is actually advisable, as Medicare benefits often duplicate group insurance coverage. Additionally, enrollment into Medicare Part B initiates certain guaranteed enrollment rights into Medicare Supplement plans, and you would not want to initiate those until the time that you are planning to use Medicare as your primary insurance.

But, if you have reached the point where you are losing your group coverage, or retiring, and enrolling in Medicare, that process is relatively straight-forward. Medicare has late enrollment penalties that would apply if you have not been covered by a group plan, so you will have to prove that you HAVE been covered. You will need two forms to do this, one of which has to be partially completed by your employer to verify that you’ve been covered. The forms that you will need are: CMS 40-B and CMS L-564 (Section B to be completed by employer).

These two forms need to be returned to a local Social Security field office in person. This should be done at least one month before you want your Medicare to start if possible.

Scenario #4: You are under 65 and on Medicare disability.

If you are already receiving Social Security disability benefits, you will be automatically enrolled into Medicare Part A and Part B after you have been receiving disability benefits for 24 months.

You do not have to sign up for Medicare if you are receiving Social Security disability. You will receive your red, white and blue Medicare card in the mail before your 25th month of disability.

Scenario #5: You are already over age 65, and you already have both parts of Medicare – Part A and Part B.

If you are already over age 65 and looking to switch to Medicare as your primary insurance, either because you are retiring or losing some other type of coverage, you may find that you actually already have both parts of Medicare – Part A and Part B. This would be true if either you were already receiving Social Security and did not let Medicare know that you did not want Part B when you turned 65 OR if you intentionally signed up for Medicare Part B even though you had other group insurance.

In these cases, you would not need to take any action. You can just start using your Medicare as your primary insurance once you other insurance ends.

NOTE: This is not ideal in most situations (employers larger than 20 employees). Typically, Medicare Part A and B would duplicate coverage offered through a group health plan and you would not need to be paying for BOTH the group plan and Medicare itself. Additionally, enrollment into Part B initiates your enrollment window for Medigap coverage, so you would not want to sign up for Part B until you were ready to use Medicare as your primary coverage.

Medicare Late Enrollment Penalties

If you do not take the corresponding action above that reflects your situation, you may be faced with Medicare late enrollment penalties. These penalties are dual in nature – you may receive a financial penalty as well as be restricted on when you can get into Medicare.

The financial penalty for late enrollment into Medicare Part B is 10% for each 12 month period that you were not enrolled but were eligible to do so.

The time period restriction is that there are certain times of year during which you can get into Medicare Part B. So, if you do not enroll on time, you may have to wait several months before your Medicare can start.

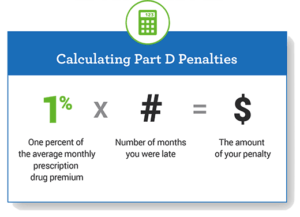

Note that there are also late enrollment penalties for Medicare Part D – 1% of the  “national base beneficiary premium” for every month that you were eligible but not enrolled.

“national base beneficiary premium” for every month that you were eligible but not enrolled.

Other Considerations

There are other considerations for enrollment into Medicare as well. When you enroll in Medicare Part B, it initiates your enrollment window into other types of plans, such as Medigap plans and Medicare Advantage plans. It is crucial to make those choices in a timely manner to avoid potentially paying more or not being eligible later.

For Medigap plans, in particular, you have a 6-month open enrollment window during which you can get a plan without health questions or underwriting. After that point, you may be forced to pay more or be ineligible altogether.

The importance of understanding when and how to enroll in Medicare is clear. However, many people still do not understand what actions they need to take or how exactly to take them – and, it can be confusing. If you have questions specific to your situation, please let us know.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.