Turning 65 is a whirlwind.

You may be retiring or thinking about retiring soon, and you’re probably getting hounded with emails and mail about Medicare and what you should do about it.

If you’re trying to figure it all out on your own… well… you don’t have to.

Our agents are ready to give you a hand at absolutely no cost to you whenever you’re ready.

But, if you’re just starting to get a feel for your new responsibilities, here are 5 things that all 65ers need to know.

5. Enroll in Medicare Part A and Part B.

When you turn 65, Medicare is officially available to you. You’ve been paying into it for long enough, so why not reap its benefits?

Part A cover inpatient care, and it’s completely free. No monthly premium for you.

Part B covers outpatient care, and it’s monthly premium, as of 2017, is $134. Note: that cost is higher if you make more than $85,000 per year (or $170,000 per year as a household).

If you’re on group coverage, and you’re still working, you need to weigh your options. You can read more about that here: https://65medicare.org/should-you-keep-your-group-insurance-when-you-turn-65.

Here’s what your timeline looks like:

→ 3 months before you turn 65, your birthday month, and 3 months after you turn 65.

If you miss this 7-month window, you’re going to be hit with some late enrollment penalties.

Here’s how to sign up, straight from Medicare.gov:

- Apply online at Social Security. If you started your online application and have your re-entry number, you can go back to Social Security to finish your application.

- Visit your local Social Security office.

- Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778).

- If you worked for a railroad, call the RRB at 1-877-772-5772.

- Complete an Application for Enrollment in Part B (CMS-40B). Get this form and instructions in Spanish. Remember, you must already have Part A to apply for Part B.

You can choose to opt out of Medicare Part B if you want, but you should discuss it with your agent first.

4. Look into Medicare Part C (Medicare Advantage).

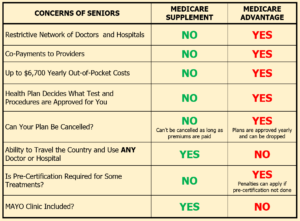

Medicare Advantage is an alternative to Medicare and Medigap plans. It often has a very low monthly premium, but it also comes with its downsides.

The first problem is the limited network. There are a lot of doctors that don’t accept Medicare Advantage. It could leave you with either no doctors in your area, or a doctor that’s not your favorite.

Also, the premium may look like a good sticker price, but there’s still hefty deductibles and co-pays. We’ve seen those range anywhere from $3,000-$7,000.

Medicare Advantage can be a good option for those in large cities. Large cities often have more doctors to choose from.

If you’re in a smaller city, you may not have any doctors, meaning you’ll have to drive a distance to see a doctor.

It’s always best to weigh your options (Read our Medicare Advantage vs. Medigap article), so don’t rule anything out until you check out your own situation and your own network of coverage.

3. Sign up for Medicare Part D.

Medicare Part D, also called a prescription drug plan, or PDP for short, helps a lot of people save money on drug costs.

The dilemma here is that many turning 65 aren’t on any prescriptions yet. Why then would you pay a monthly premium for drug coverage that you don’t need?

Great question, and here’s the answer: For every month you delay signing up for Part D, you receive a 1% penalty on the premium.

We realize that may sound a little confusing, so here’s an example.

If you had signed up for Part D when you turned 65, let’s say your monthly premium would’ve been $50.

For each month you delay signing up, your monthly premium goes up by $0.50. So, by the end of the year — 12 months later — your premium has gone up to $56. Now, you’re not paying that premium yet, but when you do sign up for Part D, that penalty will go into effect.

If you had signed up for Part D, your premium would’ve stayed at $50.

It’s often a choice that takes time to make. If you end up needing prescriptions and you don’t have a Part D plan in place… well, we all know how expensive prescriptions are. It’s a gamble — are you willing to take the risk? And the penalty?

2. Choose a Medigap plan.

Medicare does cover a good portion of your medical expenses, but you’re still left behind with a nice chunk of risk.

To put things simply, Medicare covers about 80% of your medical expenses. A Medigap plan picks up that other 20%. That’s a generalization, and it’s more complicated than that, but that’s the simple way of putting it.

To “fill in the gaps of Medicare,” many will buy a Medigap plan. This is also called a Medicare Supplement.

You can buy a policy of your choice up to 6 months after you enroll in Medicare Part B. After that — you guessed it — penalties.

One of our agents can help you choose a plan that fits your budget.

1. Consider long-term care insurance.

Long-term care insurance is a big decision to make, and it definitely shouldn’t be made in haste. However, as time goes on, your ability to even purchase it starts to decrease.

Long-term care is only available to those that can pass the rigorous health questions. As we get older, that becomes less likely, and some carriers even cap off the age you can apply right around 65.

Also, the other you get, the more expensive it gets. After the age of 65 or so, long-term care insurance starts to become very pricey, often more than many are willing to pay.

Long-term care itself is extremely expensive — it can be around $100,000 a year in many cases — so if you’re interested in getting some insurance coverage, you ought to start thinking about it now.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.