Should you change your Medigap plan if your rate increases? This is a great question and one that many Medicare beneficiaries ask as they get older and experience changes to their Medigap premiums. The short answer is “Yes!”; however, the answer is a little more complex than that.

First, let’s start with a basic fact – just like most other things in our lives and other types of insurance, your Medigap rate is going to go up over time! No matter what your insurance agent told you when you signed up, it is going to go up over time. Now, different companies may go up different amounts and future increases are very difficult to predict because they are based on claims ratios, changes to Medicare, and inflation – three variables that are uncertain. One thing that is not uncertain, though, is that the rate is going to go up. (Related: How Much Do Medigap Premiums Go Up Each Year?)

it is going to go up over time. Now, different companies may go up different amounts and future increases are very difficult to predict because they are based on claims ratios, changes to Medicare, and inflation – three variables that are uncertain. One thing that is not uncertain, though, is that the rate is going to go up. (Related: How Much Do Medigap Premiums Go Up Each Year?)

With that basic fact out of the way, WHEN it does go up, you should receive a notification by mail from your insurance company about 30-60 days in advance of when the rate is going to change. For most companies, rate changes occur in your policy anniversary month. This is usually your birthday month, assuming that you signed up for a Medigap plan the month you turned 65. The letter you receive will contain your new rate and should act as a prompt for investigating whether it makes sense to stay with the same plan or explore other options.

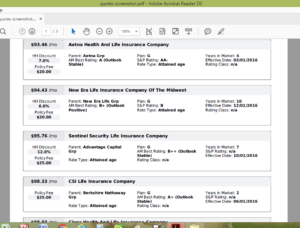

In most cases, especially if you have had the same Medigap plan for more than a year or two, there will be other options available for equivalent coverage (all plans are standardized – Medigap coverage chart) at a lower premium. If you have a broker, the broker should be able to easily provide you with a full list of plans so you can see how your rate compares to what else is available for your zip code and age. If you can save money for the same plan, it may make sense to change to a different company.

When Can You Change Your Medigap Plan?

Contrary to common misconception, you can change your Medigap plan at any time of the year. You don’t have to, and really shouldn’t, wait until the end of the year to change plans. The end of the year annual election period (what people call “open enrollment”) is all about Part D and Advantage plans and does not have anything to do with Medigap. Moreover, there are more people changing plans at that time of year and underwriting is different and slower.

The best time to change your Medigap plan is one month before your rate increase is going to take effect, making the new plan effective on the date that your current plan is changing its rate. In other words, in a hypothetical situation, you get a notice that your plan is going up in late April and the change is going to take effect on your policy anniversary date of 6/1 because that is your birthday month and you signed up when you turned 65. Once you get that notice, you review other plan premiums and see that you can save $40/month by switching from your current Medigap company to a different Medigap company for the same Plan G coverage. You can do an application in April or early May for a 6/1 effective date (usually takes 7-10 business days to be approved) and avoid the increase and save some money while keeping the same coverage.

How Do You Change Your Medigap Plan?

Changing Medigap plans is relatively easy to do, particularly if you are in pretty good health. When you first turn 65 or start on Medicare, you have an open enrollment during which you do not have to answer medical questions or be approved into a Medigap plan. However, after that initial 6 month open enrollment period, you do have to “qualify medically” in most instances (exceptions: states that have a birthday rule).

So, part of the changing process will be completing an application, providing health/medication information and going through review by an underwriter.

But the first step to changing your Medigap plan is reviewing Medigap quotes. This can be done by contacting your Medigap broker if you have one. He or she can provide you with a list of available Medigap plans and their premiums and even make recommendations based on their previous experiences with the different companies.

Once you have selected a new plan to apply for, you would complete an application for the new company. This can typically be done online or by phone in a matter of minutes. It usually takes about 7-10 days for the new company to review your application and approve it.

Medigap Underwriting Process

As mentioned above, a new Medigap policy will need to go through underwriting unless you fall into a unique situation or live in one of the states that has a “birthday rule”.

This underwriting process varies from company to company, as all companies ask different health questions and have different requirements. Aside from filling in health and medications information on the application itself, you also may need to have a telephone interview with a Medigap underwriter as part of the approval process.

Reviewing each company’s underwriting guidelines and processes is something your Medigap broker should be able to assist with as part of the company selection process.

If you have any questions about this process or would like a list of the plan options available to you, please contact us here or call us at 877.506.3378.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. If you have any questions about this information or would like to see if there is a mutual fit to work together, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. If you have any questions about this information or would like to see if there is a mutual fit to work together, you can contact us online or call us at 877.506.3378.

Initial Enrollment Period (

Initial Enrollment Period (