Almost every year, it seems that retired persons healthcare  costs go higher and higher. In order to keep your financial planning and retirement needs on track, you must be aware of all your 2018 Medicare costs. This is a vital part of your financial snapshot if you are in this phase of your life.

costs go higher and higher. In order to keep your financial planning and retirement needs on track, you must be aware of all your 2018 Medicare costs. This is a vital part of your financial snapshot if you are in this phase of your life.

It is a common myth that retirees have free healthcare. For Part A, that’s generally true. However, it is not the case for Medicare Part B, Medicare Advantage, Medicare Part D, or Medigap plans. Below you will find useful information on which costs are not free and what the costs are for 2018.

MEDICARE PART A – 2018 Medicare Costs

Medicare Part A provides for inpatient hospital stays, skilled nursing, and rehabilitation after a deductible is met and up to specific limits. An example would be if you require hospitalization for longer than 60 days, you will be required to pay a share of the expenses; after 90 days you’ll be responsible for 100% of your bill, if you’ve already used up your 60 lifetime reserve days.

You Can Get Part A Premium-Free If:

- You are already collecting benefits from Social Security or the Railroad Retirement Board.

- You’re eligible to get Social Security or Railroad benefits but haven’t filed for them yet.

- You or your spouse had Medicare-covered government employment.

If you’re under 65, you can get premium-free Part A if:

- You received Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have End-Stage Renal Disease (ESRD)and meet certain requirements.

For most people, Part A premium is free. However, some people do not qualify for it to be free. You need to have served at least 40 quarters of employment (10 years) of paying Medicare and FICA taxes while working, to be able to qualify. If you paid Medicare taxes for 30 quarters or less, Part A premium is $422. If you paid Medicare taxes for 30-39 quarters, the Part A premium is $232.

Generally, if you decide to buy Part A, you must also have Medicare Part B (Medical Insurance) and pay monthly premiums for both Part A and Part B. Contact the Social Security Administration to learn more about Part A premiums.

MEDICARE PART A – Inpatient Hospital Deductible & Coinsurance:

Deductible $1,340 (for each benefit period)

Coinsurance

- Days 1-60 $0 (for each benefit period)

- Days 61-90 $335 (per day for each benefit period)

- Days 91+ $670 (per each “lifetime reserve day” after 90 days for each benefit period (up to 60 days over your lifetime

- Beyond lifetime reserve days: You pay all costs

MEDICARE PART B Premium – 2018 Medicare Costs

The 2018 Medicare costs for the monthly Part B premium is $134, but it can be higher depending on your income (see IRMAA below). If you are already collecting Social Security benefits, the premium may be less; on average $130.

The standard premium amount of $134 pertains to you if:

- You are enrolling in Part B for the very first time

- You are not collecting Social Security benefits

- You are directly billed for the premiums

- You are on Medicare and Medicaid, and your premium is paid by Medicaid (your state pays the standard $134 premium amount)

What is IRMAA?

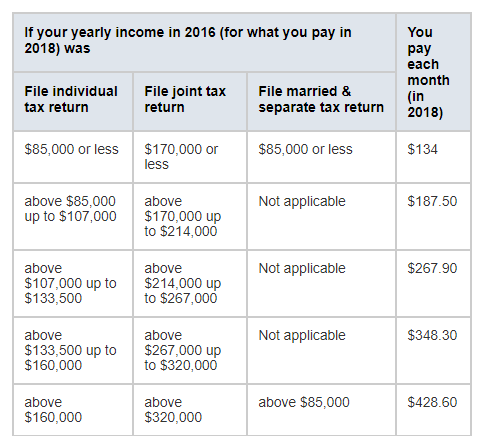

IRMAA stands for “Income Related Monthly Adjusted Amount”. If your modified adjusted gross income on your IRS tax return 2 years prior is over a certain amount, you will have to pay the standard premium amount plus an IRMAA. In short, it is an additional charge on your Part B premium (More information about IRMAA). See table below:

Important Note: If you’ve had a life changing event, i.e. you just retired, you might be qualified for a reduction on any of the above amounts. Call Social Security at 800-772-1213, to find out more.

MEDICARE PART B – Annual Deductible

The 2018 Medicare costs for the annual Part B deductible is $183/year. Once you meet that deductible, then you pay 20% coinsurance (the Medicare-approved amount) for covered services, which includes:

o Most doctor services (including while you are in the hospital)

o Any outpatient therapy

o Durable medical equipment

Clinical laboratory services: Cost is $0 for Medicare-approved services

Home health services:

– $0 for home health care services

– 20% of the Medicare-approved amount for durable medical equipment

Outpatient mental health services:

– You are entitled to a free yearly depression screening, provided that your physician or health care provider accepts assignment.

– You pay 20% of the Medicare-approved amount for doctor or other health care provider visits, to diagnose or treat your condition. Part B deductible will apply.

Please note: you may be asked to pay an additional copayment or coinsurance amount to the hospital if you get your services in a hospital outpatient clinic or outpatient department.

Mental health services requiring partial hospitalization:

– You pay a percentage of the Medicare-approved amount for doctors’ services or other qualified mental health professionals, provided they accept assignment.

– You will also pay coinsurance for services in a hospital outpatient setting or community mental health center, while you are an inpatient, and the Part B deductible will apply.

Please be aware that in 2018, there may be limits on physical therapy, occupational therapy, and speech language pathology services. If there are, there may be exceptions to these limits.

Outpatient hospital services:

– Your share is 20% of the Medicare-approved amount for physician or other health care provider’s services. Part B deductible will apply.

– You will usually pay a copayment for all other services in a hospital outpatient setting. That copayment might be higher if in a hospital outpatient setting as opposed to a doctor’s office.

– Some screenings/preventive services might be at no cost, since your coinsurance, copayments and Part B deductible will not apply.

If you have any questions about your 2018 Medicare costs, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227) for more information. TTY users call 1-877-486-2048.

Leave a Reply

You must be logged in to post a comment.