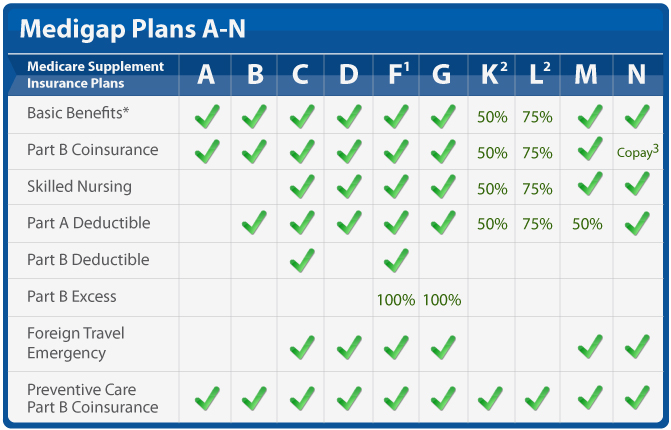

North Carolina Medigap plans go by the Federally-standardized Medigap coverage chart. This means that the plans are the same from company to company, which makes comparing plans very easy to do. Are you turning 65 in North Carolina? Or are you shopping for Medigap plans in NC?

The NC Medigap plans go by the coverage chart here:

While most of the plans are offered by one company or another, the three most common plans here in NC are the Plan F, Plan G and Plan N. Most companies offer at least 2 out of those 3 plans, with most companies offering all three of those. Those three plans represent a top level of coverage, a middle/high level of coverage and a lower coverage/lower premium option.

Although Plan F is the most coverage, it is often not the best deal (Plan F vs Plan G). The only difference between ‘G’ and ‘F’ is the coverage of the Medicare Part B deductible, which is $257/year (for 2025). Since the premium savings in NC is generally $25-30/month on ‘F’ and ‘G’, it does not make sense to pay the extra $300/year or so to cover a $257/year deductible. Additionally, Plan G is historically more stable over time than Plan F.

Get a List of Medigap Plans for Your Zip Code

Complete the form to receive the information via email

[si-contact-form form=’9′] Information will be delivered by email, typically within a few minutes of the requestWhat Companies Sell Medigap Plans in North Carolina?

There are 40+ companies licensed to sell Medigap plans in North Carolina. These companies range from large, national companies that you have heard of to smaller companies that may only do business regionally or have not been doing North Carolina Medigap plans for as long.

Although we are a national brokerage, NC is our home state, so we are especially familiar with the market here. Some of the companies that are competitively priced and reputable currently include: Mutual of Omaha, Aetna, CIGNA, United Healthcare, CSI Life, American National and others.

We recommend basing your company choice primarily on price, with a secondary consideration given to company rating/reputation. Although all companies will pay claims the same way, on the same time schedule and in the same amount, prices can vary tremendously on Medigap plans (Read more: Why Do Medigap Rates Vary So Much?). Also, there are some companies that are more stable than others over time as far as rate increases go.

How to Compare North Carolina Medigap Plans

There are really two options when it comes to comparing Medigap plans. The first option is to contact each company – either online or by phone – to talk to an agent that works for them exclusively and get a rate for their plan based on your age and zip code. Although that process may be cumbersome, time-consuming and unpleasant in some ways, that is one way to do it.

Alternatively, you can use an independent broker like us or someone else that does what we do. We are located in NC. An independent broker works for you, not a specific insurance company, although it does not cost you anything to use them. A broker can help you compare all Medigap options in a centralized place and make a selection based on their expertise, experience and the totality of what’s available in your area.

What is the Best Medigap Plan in North Carolina?

The best Medigap plan in NC really depends on where you live and what your age is. As previously outlined, the rates can vary dramatically, even for the same plan in the same geographic area. You must take the step of comparing the rates to get the best “deal”.

We generally find that Plan G is the best “deal” for most people. But there are other people/situations where another plan (i.e. Plan N) makes more sense. One important thing to remember when it comes to Medigap is that you must think about it long-term. If you take the lowest level, or one of the lowest level plans initially, you would have to “qualify medically” to move to a higher plan at a later time. So you do have to take your current health into consideration but should also consider your financial resources and how secure you want to be in your future coverage.

What is Unique about North Carolina Medigap Plans

There are a few things that are unique about Medigap plans in NC. One of those is that there are plans available for people on Medicare disability. Many states do not have Medigap options for people on Medicare under age 65. However, in NC, you do have to purchase these under-65 Medigap plans when you are first eligible for Medicare (within 6 months of when your Medicare Part B begins).

Additionally, NC Medigap plan premiums are not higher for people who use tobacco, as long as you apply within 6 months of when your Medicare Part B starts. This is called your Medicare Supplement open enrollment period.

Most of the Medigap plans in North Carolina are attained-age rated. This means that the rates are based on the age that you have “attained”. There are a few that fall into the community-rated or issue-age rated categories. But overall, the plans that have prices that are remotely competitive in NC are all attained-age. This means that your rate will go up over time as you get older. It is crucial to get the best “deal” when you are signing up for a plan from a reputable company that will be stable over time as far as rate increases go.

The Bottom Line on North Carolina Medigap Plans

Overall, comparing Medigap plans can be a daunting task, no matter where you live. In NC, the Medigap plans follow the Federally-standardized model, and it is relatively easy to compare “apples to apples” to get the best deal. All Medigap plans can be used anywhere that takes Medicare. (Read more: Do All Doctors Accept Medicare Supplement Plans?) It is crucial to take the extra step – not just of understanding the plans and how they work – but also of picking the best one based on the rates where you live and the companies that are competitively priced and reputable there.