You might be turning 65, getting ready to retire, and/or this is your first opportunity to enroll in Medicare (Turning 65 Roadmap). Whatever the situation, when turning 65 or starting Medicare after age 65, you will be bombarded with information to make a better-informed decision about your healthcare coverage. You will want to be proactive about what you need to do in preparation for this important, yet overwhelming, time in your life. The Centers for Medicare & Medicaid Services (CMS) manages Medicare. Social Security works in conjunction with CMS by enrolling people in Medicare.

To be better prepared and organized in your research and ultimately your decision, there are several steps listed below for you to follow as guidelines.

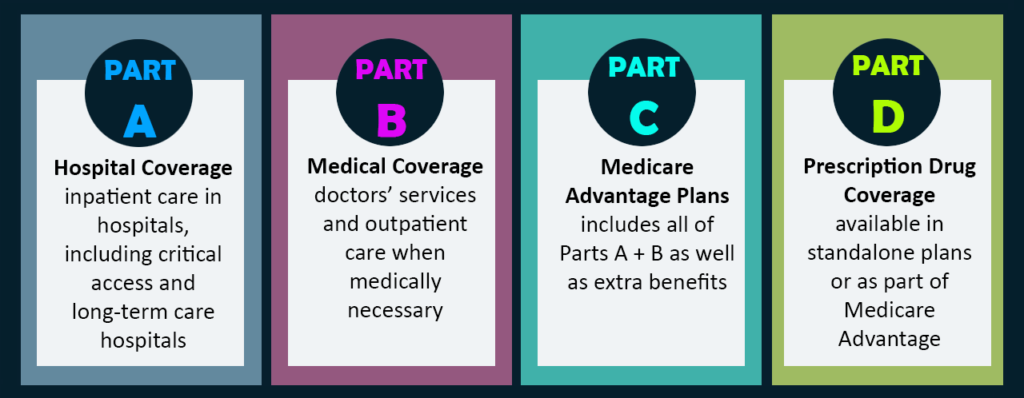

1) Familiarize yourself with the different parts of Medicare:

Original Medicare:

- Part A (hospital insurance):

Provides for inpatient hospital stays, skilled nursing, and rehabilitation after meeting a deductible and up to specific limits.

- Part B (medical insurance):

Provides for doctors’ services, outpatient care, medical equipment and supplies and preventive services

Other Parts of Medicare:

- Part C (Medicare Advantage – privatized version of Medicare):

Medicare Advantage is a completely separate part of Medicare that takes the place of Parts A and B if you elect to enroll in it. These are private plans, sold through private insurance companies, with their own set of co-pays, deductibles and out of pocket costs. (What Is the Difference Between Medigap and Medicare Advantage?)

- Part D (Prescription drug coverage):

Prescription drug coverage for people on Medicare falls under Medicare Part D. This is a completely optional part of Medicare, but it is the only way to have prescription drug coverage once you are on Medicare. Some Part C (Medicare Advantage plans) also include Part D. (Do I Have to Sign Up for a Medicare Part D Plan?)

2) Know when you can enroll in Medicare:

When you enroll in Medicare depends upon your situation – you may be able to be enrolled automatically, or you may have to sign up yourself. However, there are certain times during the year when you are also able to enroll.

Get Medicare Automatically:

You can get Medicare automatically if you are already getting Social Security benefits, or the Railroad Retirement Board. Social Security will send you your Red, White & Blue card three months before you turn 65, and your benefits will begin on the first of the month that you turn 65. If your birthday is on the first of the month, then your benefits begin on the first day of the previous month.

If you are not currently receiving Social Security benefits, you will need to sign up for Part A and Part B by either going online at www.SSA.gov, or calling them at 1-800-772-1213. TTY users call 1-800-325-0778. You may also sign up in person at your local Social Security office. If you are a retired railroad worker, you can enroll in Medicare by calling the Railroad Retirement Board at 1-877-772-5772. TTY users call 1-312-751-4701.

The Initial Enrollment Period:

This is for Medicare beneficiaries who are enrolling for the first time in Parts A and B. It covers a 7-month period, starting 3 months prior to the month in which you turn 65, including the month in which you turn 65; ending in 3 months following the month in which you turn 65. (Medicare Supplement Open Enrollment)

Eligibility and Premium Calculator:

If you want to find out when you are eligible for Medicare and how much the premium will be, go to www.Medicare.gov/eligibilitypremiumcalc/. There you will be able to learn when your eligibility will begin and your exact premium will be calculated for you.

3) Do I Want Both Part A and Part B?

It is up to you whether you want Part A and Part B. If you have been employed and paid Medicare taxes, then for you, the Part A premium would be $0. Typically, if you have paid Medicare taxes, you are enrolled into Medicare Part A automatically upon reaching the month of your 65th birthday.

If you do have your health insurance with your employer, then you may decide to delay Part B when turning 65 (see below). It all boils down to how good your present coverage is as far as deductible, copays, etc. But you should take care when considering whether you should enroll in Part B if you are intending to keep group coverage. Doing so initiates certain enrollment time periods that you would not have in the future when you do retire or lose the group coverage.

If you are enrolling in Part B for the first time your premium in 2018 is $134/month. However, you may pay more if your modified adjusted gross income on your 2016 IRS tax return is higher. This increase is called “IRMAA” (Income Related Monthly Adjustment Amount).

Part B late enrollment penalty: If you don’t have credible coverage, you may have to pay a penalty if you don’t enroll during your initial enrollment period when turning 65, in addition to a gap in coverage when you do decide to enroll. (Medicare Late Enrollment Penalties)

4) Consider Enhancing Your Medicare Part A and Part B:

Once you choose to enroll in Part A and Part B, you can either choose Original Medicare with additional coverage of a Medigap plan; or enroll in a Medicare Advantage plan (Part C – either an HMO or PPO depending upon the plans available in your county). You can also get prescription drug coverage (Part D). Important to note is that you may have to pay a penalty if you do not enroll in Part D during your initial enrollment period, if you choose Original Medicare. This does not pertain to Part C, as that already includes prescription drugs.

You can find and compare Medicare Advantage plans as well as prescription drug plans by going to www.medicare.gov/find-a-plan. By entering your medications, you will be able to see what the most cost-effective drug plan will be when you do the comparison.

5) Choosing a Medicare Supplement (Medigap Plan):

If you decide to enroll in a Medigap plan, you should compare Medigap quotes on each of the plans you are considering. Also, you should compare the yearly deductibles, copays, and coverage for foreign travel on the different standardized plans. The most popular plans are F, G, and N, although Plan F will be closed to new enrollees starting in 2020.

Plan F = $0 deductible/$0 copay

Plan G = $183 Medicare Part B deductible/$0 copay

Plan N = $183 Medicare Part B deductible; up to $20 copay for outpatient/doctor visits; up to $50 copay for an ER visit if you are not admitted; and up to 15% excess charges (Medicare assignment below).

To get a list of the Medigap plans available for your age and zip code when turning 65, as well as company ratings, request Medigap quotes by email. This list of plans, premiums and ratings will allow you to compare all options in a centralized place.

Some companies allow you to apply online in just a few minutes (apply for Mutual of Omaha Medigap).

6) Make Sure Your Doctor Accepts Medicare Assignment:

To lower your costs, make sure that your doctor/provider/supplier accepts Medicare Assignment. This means that they agree to accept the amount that is approved by Medicare as full payment for covered services. If they do not accept assignment, then you might pay more for your covered services. If you have a Medigap Plan N, you may have to pay up to 15% in excess charges.

To summarize, don’t wait until the last minute before you turn age 65. Do your due diligence in finding out about your Medicare options, supplemental coverage and late penalties if you do not enroll in a timely fashion. Be informed, knowledgeable, and prepared and you’ll be able to get through this Medicare maze with ease!

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.