One minute, you’re talking to your friend in a different state who pays $100/mo for her Medigap rate, and the next minute, you’re being quoted $150/mo for the same exact plan!

We promise that agents and insurance carriers aren’t discriminating against you. They also don’t choose a random number and roll with it, even though it may seem that way sometimes.

While a gallon of milk is the same cost for you and your neighbor, Medigap rates vary wildly depending on several different factors.

Let’s break those down together. Skip this… I just want the list of Medigap rates by email

Get a List of Medigap Rates for Your Area

Complete the form to receive the information via email

[si-contact-form form=’9′] Information will be delivered by email, typically within a few minutes of the requestFirst Thing’s First – Plan Standardization

Medigap plans are standardized. So, your Plan G is going to give you the same coverage as your friend’s Plan G.

This is important to know, because prices do vary by carrier. We’ll get to the “why” part later, but knowing that the plans are the same across the board gives you the freedom to price shop, comparing “apples to apples”.

While price isn’t everything — you do want to consider the integrity of the company, its AM Best Rating, and its history — Medigap rates should be the primary basis for your decision.

The rest of this article will go over why price varies according to location, age, and carrier.

Location Determines Medigap Rates

Where you live will play a big role in how much your personal Medigap plan costs. The reason why can get a little messy and confusing, but here’s the gist: Each state has the liberty to make different legislation.

This means that Medigap rates will vary from state to state. Factors like availability, regulation of Medicare plans, and Medicare beneficiaries in different areas will change how the pricing is done.

Another big factor is that, in general, it’s hard to switch from one Medigap plan to another, especially if you’re health isn’t in tip-top shape. Some states have recognized this, and they’ve passed legislation to make it easier to switch.

States like California, Oregon, Maine, and Missouri have done this. This means that unhealthy people are switching onto different plans, which means those plans are bound to shoot up in price.

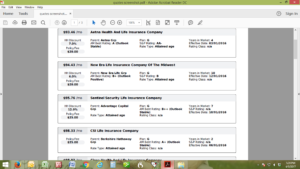

Prices vary a lot, from about $139/month in Hawaii to $226/month in New York for the same plan. And, actually, rates can even vary considerably by zip code within the same state. It’s always best to price check plans based on where you live — not by what the “average” might be.

Age Determines Medigap Rates

Medigap policies are priced based on three different models:

1) Attained-age pricing

3) Issue-age pricing

Attained-age means that every year, your Medigap premium goes up. Community-rated means that age does not affect your premiums. Issue-age means that your premium will be locked in when you purchase your plan. So, if you purchase a plan at age 70, you get the 70-year-old rate for life.

Now, with all of these models, premiums can still go up from factors like inflation and just general rate increases, but as you can see, age often does determine how much a plan will cost.

You’ll see how this all comes together — different states will allow different types of pricing models. For example, Florida and Georgia do not allow attained-age pricing. This adds a piece of complexity into the puzzle. The link between age and location (in relation to your Medigap rates) is often tied together.

Carrier Determines Medigap Rates

Like you read earlier, a Plan G is a Plan G. This is federally regulated, so you’re able to price shop different companies and know that the coverage is exactly the same.

So, if the coverage is the same, why would it be more expensive with another carrier?

Each company has their own set of health questions. Those companies choose who they want to accept based off of how you answer them. The companies that have harder health questions will offer a cheaper price, while the opposite is also true for the easier companies.

Another big factor is rate increases. If one company has to pay out a lot of claims, you’ll probably end up seeing a rate increase. This will vary wildly from carrier to carrier, and it all comes down to who they accept or decline.

Lastly, Medigap rates are just like anything else on the free market – companies decide how to set their premiums, based on which customers they want to attract (and from which geographic area) and what price point it takes to reach those customers.

How Much Will It Cost Me?

You can probably see now why it’s impossible to put a “pricing” page on the internet. We’d probably be getting a lot of calls complaining about inaccurate it is. Moreover, some companies don’t even allow their rates to be quoted online. Plus, rates can change on a month to month basis. So, a list of rates that you DO find is likely to be inaccurate (even on state department of insurance websites) and certain to be incomplete, which is why you typically have to request Medigap rates by email.

Price just varies so much based on where you live, how old you are, and which carrier you go with. That’s why you’ll find many different websites (including ours) that will ask you to request a quote.

It’s a very personalized service, and you can see why that’s the only real way to do it right.

Please note, though, that even if you do end up paying more than someone else, your coverage is the same. The same goes if you end up paying less. You don’t get less coverage — remember that every plan is standardized.

If you’re really interested in getting an idea of how much a Medigap plan would cost you in your specific location and for your specific age, you should contact an independent broker to provide a list of available options.

We can compare different companies and we’ll pinpoint your rate based on your own situation.

You can do that here: Medigap Quotes

If you have any questions about how rates are calculated, don’t hesitate to reach out to us!

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.