The “Medicare and You” booklet that Medicare publishes each year and disseminates to Medicare beneficiaries is under some serious scrutiny from three of the leading senior consumer advocate groups. The groups – the Medicare Rights Center, the Center for Medicare Advocacy, and Justice in Aging – allege that the book contains multiple inaccuracies, primarily relating to the differences in original Medicare and Medicare Advantage.

to Medicare beneficiaries is under some serious scrutiny from three of the leading senior consumer advocate groups. The groups – the Medicare Rights Center, the Center for Medicare Advocacy, and Justice in Aging – allege that the book contains multiple inaccuracies, primarily relating to the differences in original Medicare and Medicare Advantage.

Each year, millions of Medicare beneficiaries and their families rely on the information in the “Medicare and You” publication to make healthcare and insurance decisions for the following calendar year. The draft of the 2019 “Medicare and You” book was published in May, and soon after, the three non-profit groups issued a joint letter to Seema Verma, Administrator of the Centers for Medicare & Medicaid Services (CMS). The letter urges CMS to rectify errors in the draft version prior to issuing the 2019 version of the booklet.

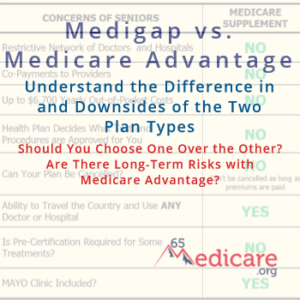

The three groups, which advocate for Medicare beneficiaries as opposed to one specific type of insurance plan, outline several significant inaccuracies/biases in the book, including:

- The book does not adequately inform Medicare beneficiaries about the network-based requirements that are inherent in Medicare Advantage programs

- It presents “prior authorization” that is required in Medicare Advantage plans as a “right” that is not available in “original” Medicare. In reality, this is an extra step required of Medicare Advantage members before they can access care, as opposed to Medicare itself, which does not have that requirement.

- Third, the draft version of 2019 “Medicare and You” implies that Medicare Advantage is the clear-cut less expensive option for all beneficiaries. This is a sweeping generalization that does not take into account the numerous variables that impact a Medicare beneficiary choosing the coverage options that are most suited to their individual needs.

This is not the first time there have been widespread objections to the information published in “Medicare and You”. Many stakeholders in the Medicare and Medicare insurance market have encountered Medicare beneficiaries that have been misinformed or confused by the information presented in the book in previous years.

As one example, the “Medicare and You” book always lists all available Medicare Advantage plans for a beneficiaries county, while not listing any Medigap providers or Medigap rates. While the reasons for this are obvious – CMS has oversight of Medicare Advantage and not Medigap – this does cause confusion and misunderstanding for many beneficiaries when selecting a plan.

Medicare Rights President Joe Baker issued a written statement:

“From the Medicare Rights Center’s experience assisting people with Medicare and their families, we know how challenging it can be for beneficiaries to make the best coverage decision for their unique circumstances. The Medicare & You Handbook must support this decision-making process by accurately describing the rules, restrictions, and benefits of both Original Medicare and Medicare Advantage. Regardless of the coverage they ultimately select, all people with Medicare deserve the opportunity to make an informed choice. We commend CMS for incorporating many of the language changes we suggested in prior years, and urge the agency to address our concerns with the draft 2019 Handbook prior to its publication.”

It remains to be seen what will be done in response to the groups’ letter to CMS, if anything. What is certain is that Medicare beneficiaries absolutely must take the time and due diligence to understand Medicare and their Medicare options for themselves. Just like you cannot take what a friend, insurance agent or neighbor says about Medicare as the absolute truth without examining for yourself, you likewise should take carefully consider anything you read from Medicare itself. This can be challenging, but it is essential to making an informed, prudent choice on these important matters.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

NOTE: This article contains outdated figures, as some of the Medicare premiums and benefits change each year. For updated information, please refer to other pages on our site like this:

NOTE: This article contains outdated figures, as some of the Medicare premiums and benefits change each year. For updated information, please refer to other pages on our site like this: