What is the Best Medigap plan? This is a question that gets asked time and time again. However, there is no easy answer, as Medigap plans and rates vary considerably by state, even by zip code. So, when you are looking for the best Medigap plan for 2025 and beyond, how do you start?

Actually, there is an easy methodology for figuring out which is the best Medigap plan for your specific situation.

I understand all of this – skip me ahead and tell me the best Medigap plan in my zip code.

Get a List of the Rates and Company Ratings to Determine the Best Medigap Plan for Your Zip Code

Complete the form to receive a list of the rates and company ratings to determine the best Medigap plan in your specific zip code.

[si-contact-form form=’9′] I hate spam too, so I will never send any to you!To Find the Best Medigap Plan, Understand Standardization

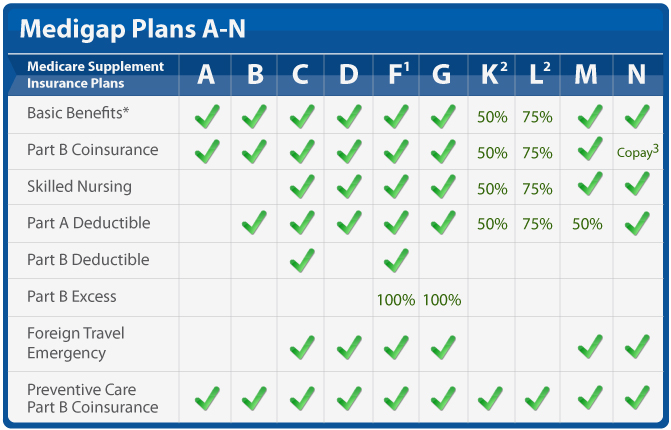

First and foremost, you must understand the standardization of Medigap plans. This means that all Medigap plans, regardless of the company that sells them, are required to go by the standardized Medigap coverage chart. This means that a Plan G, for example, is the exact same with one company as it is with another. It covers the same “gaps” in Medicare.

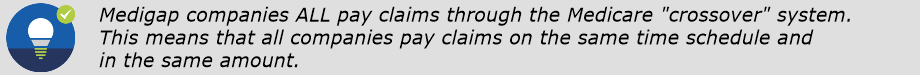

But, the plan standardization does not stop there. In addition to being the exact same coverage and providing the same benefits, all Medigap plans also work the same way. They are all non-network plans that can be used at any doctor/hospital that takes Medicare. Moreover, they all pay claims through the Medicare “crossover” system, which is Medicare’s electronic system for paying claims to the medical providers that requires no patient involvement or paper claims.

So, once you understand that you are buying a “commodity” product, how do you determine the best Medigap insurance company for your area? $$$$ That’s right – it’s all about the money!

Since the plans are standardized, the primary (some would say only) factor you should be considering when comparing Medigap plans is the premium that a company charges for the plan that you want. The best Medigap plans are also the lowest priced Medigap plans. And, the best Medigap insurance companies are the ones that charge the best rates for the standardized (same exact coverage) plans. Premiums can vary considerably from different companies, as much as $100 for the same exact plan. You have to do your homework on this and not jump on the first piece of direct mail you receive or first advice from a friend who says their plan “pays all their claims” (they all do).

Compare Medigap Plans: Coverage

When you are looking at the prices, note that there are actually 10 different standardized Medigap plans. However, the three most common are Plan F (most comprehensive), Plan G (usually the best “deal”) and Plan N (lower premium, lower coverage). Those are the three Medigap plans that most companies choose to offer. It is crucial to understand these and compare Medigap plans on an “apples to apples” basis.

The first step is deciding where you want to fit in that spectrum of coverage choices. Comparing Plan F and Plan G is very easy to do because there is only one coverage difference – coverage of the Medicare Part B deductible, currently $257/year (for 2025). Plan F pays all the Medicare deductibles and co-pays, whereas Plan G does not cover this Part B deductible but does cover everything else not covered by Medicare. So, if the premium savings on ‘G’, as compared to ‘F’ premiums, are greater than $20/month, you would come out better on ‘G’ than ‘F’. NOTE: Plan F is not available to you if you turned 65 or started on Medicare after 1/1/2020.

You may think Plan N is the best Medigap plan for you, and it very well may be if you are in good health with limited doctor visits annually. Plan N is always a lower-premium option, but it does have some cost-sharing (i.e. co-pays).

Aside from the three common plans – Plans F, G and N – there are also other Medigap plans. While these are not commonly offered in most states, it is a good idea to take a look to see if one of those options would also be a good “deal” for you.

Get a List of Medigap Plans for Your Zip Code

Complete the form to receive the information via email

[si-contact-form form=’9′] I hate spam too, so I will never send any to you!When choosing a Medigap plan, always keep in mind that your initial selection is not permanent. You can change plans at any time for any reason, and there is not an annual enrollment period for this type of coverage (only for Medicare Part D). However, it is crucial to understand that you do have to “qualify medically” to change plans or companies at a later time.

Getting Rates for the Best Medigap Plan for You

So, we’ve now established that you need to compare rates on to find the best Medigap plan for your specific situation. And, how do you go about doing that? There are two options – first, you can get a list of insurance companies that do Medigap plans in your state and either call them on search them out online to talk to a specific agent for that company and attempt to get the rates. Remember, you can determine the best Medigap insurance companies by comparing rates to see who has the best “deal”. But, does calling 40+ insurance companies or agents sound fun? Easy?

The second option, which is more advisable, is to use an independent Medigap broker to help you compare the Medigap plans. This does not cost you anything. And, a true independent broker works with all the available companies in your state, so they can give you all the options in a centralized place and answer your questions in an unbiased way.

So besides the premium rates, what else should you look at when looking for the best Medigap plan from the best Medigap insurance company? A secondary factor to look at is the reputation, or rating, of the insurance company itself. A broker should be able to provide this information, as well as personal anecdotes about the company’s rate increase history and track record of stability.

Now, 65Medicare.org can help you compare Medigap plans. We’ve helped tens of thousands of people turning 65 over the last 10 years do just that. But, whether it is us or someone else, it is highly recommended to use an independent broker to compare plans and find the best Medigap plan for your specific situation and needs.

If you have specific questions about this or want a list of the plans for your area, you can contact us online or at 877.506.3378.

Best Medigap Plans 2025

Each year, Medigap rates change. As previously discussed, the best Medigap plans for 2025 are the plans with the lowest rates. The premium rates for Medigap plans are and should be the primary factor in choosing a Medigap plan. So, when rates change, your should “shop” to see which are the best Medigap plans for your specific area.

In addition to the Medigap premiums potentially changing annually, the Medicare deductibles and coinsurance structures can also change from year to year. When they do, some of the Medigap plans are affected as well. If your plan does cover the Medicare Part B deductible (i.e. Plan F), the rates for your plan may go up or change as a result of that change to the Medicare deductible. New article: Best Medigap plans in NC

Best Medigap Plan G

One of the most common and popular plans over the last few years has been Medigap Plan G. Plan G is a great option, and in many cases, is the best deal among the different Medigap plans. But is it the best Medigap plan?

That depends on the rate spread between Plan G and Plan F really. The current Medicare Part B deductible for 2025 is $257/year. That is the benefit that is not covered under Plan G and the only out of pocket cost associated with Plan G. So in other words, if the premium savings on Plan G vs. Plan F is greater than $257/year, then Plan G would be a better option than Plan F. In most situations, this is the case. However, you should always compare specific companies/rates for your area when you are comparing Medigap plans.

If you have questions about any of this or would like a customized list of the plans available to you, so that you can pick out the best Medigap plan, you can contact us at 877.506.3378 or here: Medigap quotes.