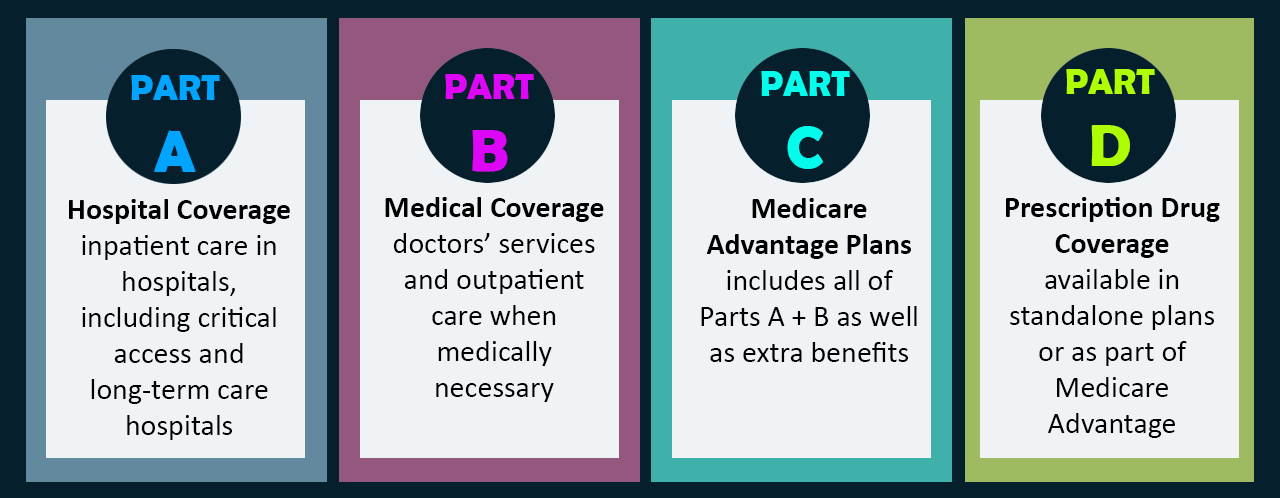

There are several types of supplemental insurance that work with Medicare. Medicare is a government-sponsored health insurance program for those who are 65 years old or older, or those who are disabled or qualify because of end-stage renal disease (permanent kidney failure requiring continuous dialysis treatment or a kidney transplant) or Lou Gehrig’s disease (amyotrophic lateral sclerosis). The basic program is called Original Medicare and includes Part A (hospital insurance) and Part B (medical insurance). However, Medicare only covers 80% of your hospital or medical costs. There are a few options for you to consider when deciding whether you need more coverage or not. It is all up to you. Those options are listed below.

- Keep Original Medicare (Parts A and B) and do not get additional supplemental insurance. The 20% of out-of-pocket costs that Original Medicare doesn’t pay for will be your responsibility. You will pay your monthly Part B monthly premium. Some people may “opt out” of Part B if they have group coverage through their employer (see below)

- Stay with Original Medicare and enroll in a stand-alone Medicare Part D Prescription Drug Plan, since Original Medicare does not include prescription drug coverage. These plans are available from private, Medicare-approved insurance companies.

- If you choose Medicare Part C, you can get your Medicare Part A and Part B benefits through a Medicare Advantage plan. Many Medicare Advantage plans also cover routine vision or dental care or other benefits. Hospice care is covered directly by Medicare Part A when you have a Medicare Advantage plan. In this scenario, your Medicare Advantage plan acts as your insurance provider, not Original Medicare. However, you would continue paying your monthly Medicare Part B premium, in addition to the premium your Medicare Advantage plan charges.

- The types of Medicare Advantage plans available in your area (they vary according to which county you live in) may include Preferred Provider Organization (PPO) plans, Health Maintenance Organization (HMO) plans, Medical Savings Account plans (MSA) and others.

- Most Medicare Advantage plans include prescription drug coverage; these are called Medicare Advantage Prescription Drug plans

- Additional benefits, for example, vision and dental coverage are offered by most Medicare Advantage plans.

- The out-of-pocket expenses may vary from plan to plan.

Please note that if you enroll in a Medicare Advantage Plan, you cannot also purchase a Medicare Supplement Plan (Medigap).

- Stay with Original Medicare and add a Medicare Supplement (Medigap) plan to help pay for Original Medicare’s out-of-pocket costs, which may include copayments, coinsurance and deductibles. Medicare supplement insurance companies can only sell you a standardized Medicare supplement policy. They are standardized because they must offer the same basic benefits, no matter which insurance company sells it. Administrative costs and the customer service they offer, are usually the only difference between Medicare supplement policies sold by different insurance companies.

Should I Enroll in Medicare Part B?

Should I Enroll in Medicare Part B If I Have Group Employer or Union Coverage?

- If you or your spouse (or family member if disabled) are still working, you may have the choice of staying on your employer’s/union group health plan or not. You will need to contact your employer or union benefits administrator to find out whether you must drop your present coverage and get Medicare Part B (medical insurance) or not. This includes federal or state employment, coverage through SHOP (Health Insurance Marketplace Small Business Health Options Program), and those serving in the military on active duty. Delaying your enrollment in Part B may be more beneficial.

- You can sign up for Medicare Part A and/or Part B, during a Special Enrollment Period if you or your spouse are still working (or if you are disabled, a family member’s):

- While you are still covered by a group health plan

- During the 8-month period beginning the month following the termination of your employment or coverage, whichever occurs first

- Please note that group/union coverage excludes the following:

- COBRA

- VA coverage

- Retiree coverage

- Individual health coverage

Should I Enroll in Medicare Part B If I Have a Plan Through the Health Insurance Marketplace?

- If you have your coverage through an Individual Marketplace plan, it might be advantageous for you to enroll in Medicare during your Initial Enrollment Period (the 7-month period beginning 3 months before the month you turn 65, including the month you turn 65, and ending 3 months after the month you turn 65), to avoid paying a late enrollment penalty for Medicare coverage in the future.

- If you continue getting help paying your Marketplace plan premium after you enroll in Medicare, you might be penalized by having to pay back that extra help when filing your faxes. You can visit HealthCare.gov to find out more.

Should I Enroll in Medicare Part B If I Have TRICARE?

- If you are active duty military (including your family), you will have the health care program called, “TRICARE.” Be aware that you must enroll in Medicare Part A and B during your Initial Enrollment Period, to keep this coverage. If you have Medicare Part A, you must also have Medicare Part B to remain eligible for TRICARE, including prescription drug coverage.

- You do not need to sign up for Part B if you’re:

- An active duty service member

- An active duty family member

- Enrolled in TRICARE Reserve Select, TRICARE Retired Reserve, TRICARE Young Adult, or the The US Family Health Plan.

Should I Enroll in Medicare Part B If I Have a Health Savings Account?

Once your Medicare coverage starts, you will not be able to contribute to your HSA. If you do contribute after that, you may be obligated to pay a tax penalty. DO NOT APPLY FOR MEDICARE, SOCIAL SECURITY, OR RAILROAD RETIREMENT BOARD BENEFITS IF YOU WOULD LIKE TO CONTINUE CONTRIBUTING TO YOUR HSA!

Before you make any decision about which option to choose for your health insurance coverage, learn as much as you can about what is available to you. An independent broker can help you to compare coverages, and get information on benefits, and estimated costs, to help you find a suitable plan that will meet your needs.

You can also call Medicare at 1-800-MEDICARE (1-800-633-4227). TTY users call 1-877-486-2048