Medicare surprises can catch you off-guard if you are not prepared for them. Most people do not study or think about Medicare until they begin to approach their 65th birthday. Because of that, in addition to the abundance of misinformation out there about Medicare, there are several Medicare surprises that most people discover as they approach their 65th birthday.

Medicare can be a welcome relief for many people who are turning 65, particularly if you have been paying the high premiums for your for own individual health insurance the last few years. But, here are three Medicare surprises that you may not know prior to researching and understanding Medicare.

-

MEDICARE SURPRISE #1: IT’S NOT FREE.

Sure, you have been paying for Medicare your whole working life in the form of payroll deductions. Surely, the Federal Government has been safely storing your money in a bank somewhere to be used to “give” you Medicare when you turn 65, right?

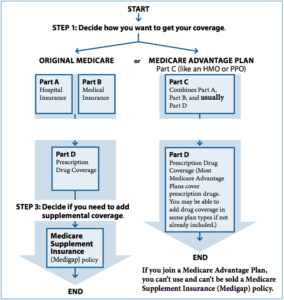

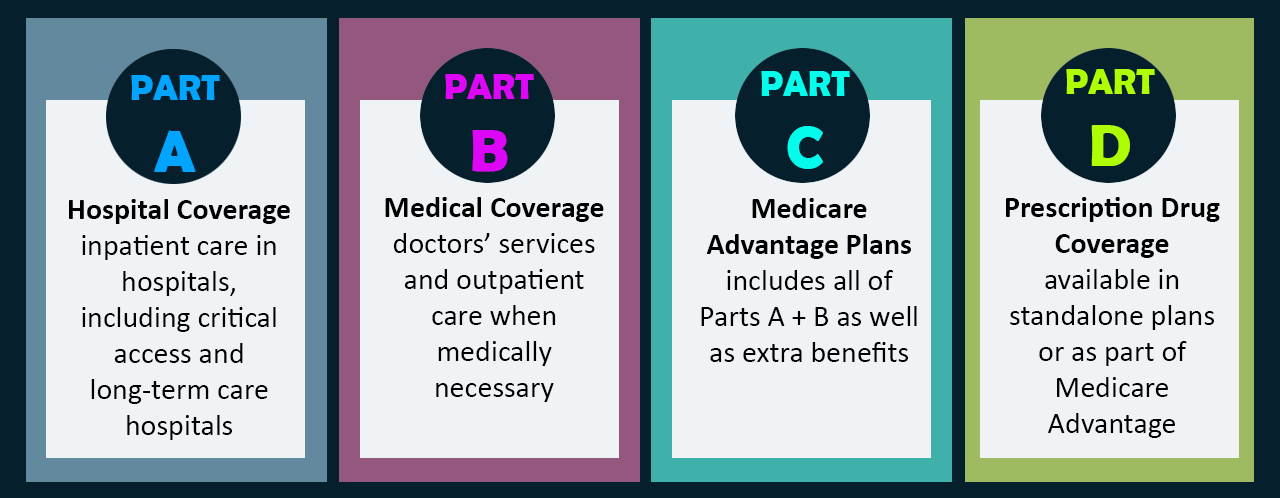

Well, not exactly. Medicare Part A (hospital) is premium-free currently, as long as you have worked 10 years and paid into the “system”. However, there is a premium for Medicare Part B. Currently, the standard Medicare Part B premium is $148.50/month (for 2021), although the exact premium you will pay is determined in some part by your income. If you fall into a higher income category, you could be responsible for IRMAA. And, if you fall into a lower-income category, you may be eligible for assistance in paying for Part B premiums.

-

MEDICARE SURPRISE #2: IT DOES NOT COVER EVERYTHING

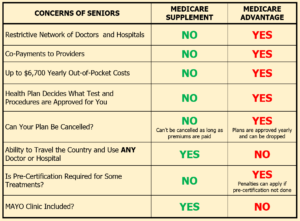

Medicare is certainly comprehensive coverage – in fact, over 75% of people who are on it are “very satisfied” with it according to a 2016 study by the Kaiser Family Foundation. That said, a number of those 75% have some sort of supplemental insurance or additional plan(s) to go with Medicare. Medicare, in and of itself, is not 100% full coverage.

On the contrary, Medicare has deductibles and co-pays that are not covered by traditional Medicare. If you have “only” Medicare and no other types of supplemental or group coverage, you are responsible for a Part A deductible ($1484/benefit period for 2021), Part B deductible ($203/year for 2021) and an uncapped 20% coinsurance. The “uncapped” is the key word in the previous sentence because it represents unlimited medical costs if you were to have hefty medical bills.

This is also why such a large number of people (approximately 25%) purchase Medigap plans. Another quarter of the people, roughly speaking and based on 2019 figures, are enrolled in a Medicare Advantage plan. These number don’t include or account for another quarter of people who are dual-eligible for Medicare and Medicaid.

-

MEDICARE SURPRISE #3: IT IS NOT A ONE-TIME DECISION

This Medicare surprise catches you off-guard. Most people spend hours on their Medicare-related decisions leading up to their 65th birthday. Then, they think they are finished for the rest of their lives. You certainly can do it that way; however, it is not prudent financially to do so.

Some types of plans change over time – Part D prescription plans, in particular, which can have dramatic costs and formulary changes annually. Others, like Medigap, never change coverage but can change premiums over time. If you use a “set it and forget it” methodology when it comes to Medicare, you will almost certainly be paying too much by the time you are 70 years old.

The best course of action is to periodically review your plan choices – annually or bi-annually usually works best – to make sure that you have the best available deals for your specific needs (Is Plan G a better deal than Plan F?). A good independent broker should proactively contact you or stay in touch with you in order to help with this.

Medicare surprises are not out of the ordinary – instead, they are pretty commonplace, as most people do not think about Medicare until it is time for them to receive it. These are three common, unexpected surprises that people receive when they do reach the golden age of 65.

____________

65Medicare.org is a leading, independent Medicare insurance agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.