Pennsylvania Medigap plans can be an important part of your financial plan if you live in PA and are on Medicare. If you are enrolled in Original Medicare only, your coverage provides for hospital stays and doctor visits, but does not cover you for all these costs. In addition, there may be deductibles and copayments. As a result, these amounts (generally 20% of what Medicare doesn’t pay), can add up substantially and eat into your pockets deeper. For PA residents, that’s where a Pennsylvania Medigap plan can help.

Medigap insurance (also called Medicare Supplement insurance) is private insurance that covers the gaps that Medicare doesn’t cover. As an example, if you were admitted to the hospital and receive a bill, the amount that is approved by Medicare will be paid before your Medicare Supplement insurance company pays any other costs, i.e. deductibles or copays.

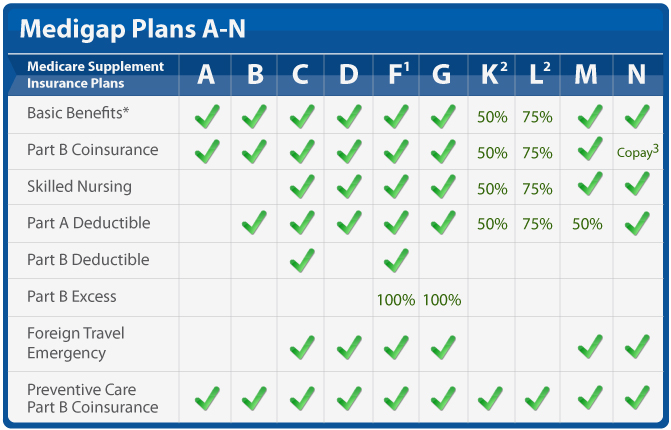

Each of the 10 Medicare Supplement plans offered in Pennsylvania are identified by a letter (A-N). All Medigap plans are standardized – not only do they have to follow federal and state laws implemented to protect the consumer, but they must be clearly marked as “Medicare Supplement Insurance”. All plans with the same letter offer the exact same benefits, no matter which insurance company sells the plan. However, premiums rates can vary considerably from company to company. The type of benefits and how many benefits covered by each plan determines how expensive it is. Below is a table outlining the various benefits provided by each plan:

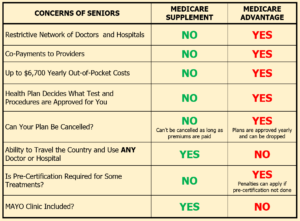

In addition to standardized benefits for Medigap plans, there are no “networks” of doctors/health care providers you must go to. You can see any provider that accepts Medicare patients. The same is true for the claims process. All claims, no matter which insurance company provides the plan, are paid the same according to Medicare’s “crossover” system. For example, claims are paid in the same manner and through the same system, whether you have an Aetna Plan G, Cigna Plan G, or a Pennsylvania Medigap Plan G with any other company.

As far as differences between Pennsylvania plans and other states, please see below:

- There are over 30 insurance companies currently offering Medigap plans in the PA. Not all these companies offer plans in other states. Some are well-known names, i.e. Mutual of Omaha, AARP Medicare Supplement from United Healthcare, Aetna or Cigna. On the other hand, others are smaller, regional or local companies as Highmark and Capital BCBS. Competitive rates and the reputation of the company are two factors that will help to narrow down your options for going with one company over another. At present, the companies with the most competitive PA Medigap rates are Mutual of Omaha, Aetna and CSI Life. To get a Pennsylvania Medigap quotes by email, you can request Medigap quotes.

- Another unique feature of PA Medigap rates is how those rates are determined. Most premiums are calculated based upon age, gender, and zip code. However, in PA, there are between two and three geographical rate areas depending on the company. Generally speaking, although there are exceptions, Medigap rates in highly populated cities are higher.

- For those who are under 65 years of age, the availability of Medigap plans varies from state to state. Some states do not even offer plans to the under-65 population. However, PA under-65 plans are available, if you are applying during your open enrollment period, which starts when you enroll in Medicare Part B. Also, under-65 Medigap rates in PA are often the same as over-65 rates, which is not the case in most states.

- Tobacco use rates during open enrollment can also vary from state to state. In PA, whether you use tobacco or not, does not apply here.

To get a plan with the most competitive rates, you should enroll in a Pennsylvania Medigap plan during your open enrollment, 6-month period. Otherwise, you may have to pay more for your plan. After your 6-month window closes, you will have to medically qualify for a plan and if you have any serious health conditions, you can even be declined.

Finally, there is a misconception that you can only apply for a Medicare Supplement during the annual enrollment period (Oct. 15-Dec. 7). This only pertains to Part D, prescription drug plans and Medicare Advantage plans.

If you have any questions about Pennsylvania Medigap plans or want to get a PA Medigap comparison, you can contact us online or call us at 877.506.3378.