Embed This Image On Your Site (copy code below):

Should I Consider an Attained-Age Medigap Policy?

You might have heard the terms attained-age, issue-age, and community rated, when doing your research on which type of Medigap policy to buy. These are the three methodologies for rating the Medigap policies that various insurance carriers offer.

It is important to note that, while you can certainly select a preferred rating methodology to sign up for, there is no guarantee that plans using this methodology are available in your state. In some states, all the plans use a certain rating system by law. In many states, there are only one or two very high priced options for community rated and issue-age rated plans. Nationally, attained-age rated policies comprise, by far, the majority of policies that are offered.

We’ve clarified the nuances of each of these three rating methodologies below:

Community Rated Medigap Policies

These are probably the easiest to comprehend of all three plans. They may also be known as “no age-rated” plans. Everyone is grouped together, no matter what your age, gender, or health condition. In other words, you are charged the same premium as other people living in your area regardless of your age, whether you are a male or female, or whether you are in good health or not.

This type of rating may be advantageous for someone living in expensive areas as opposed to those living in rural areas. It also may be beneficial for males versus females, since male Medigap premiums tend to be higher than their counterparts. In addition, in some larger states, as Pennsylvania or Texas, community rates may differ depending on which part of the state you are in. These plans can be less expensive over time, even when taking inflation and other factors into consideration. However, they do still go up – each year in most cases – based on inflation, changes to Medicare and other factors.

Issue-Age Rated Medigap Policies

This rating class is also known as “entry age-rated.” The premium depends on your age at the time of your application (when it is issued). For example, John is 75 and purchases Medigap policy with a premium of $187 per month. Judy buys a policy when she is 69 years old and pays $148 per month. John’s plan costs more because he is older when he buys it. This premium will not increase based on your age, but it will be affected by inflation and other factors, causing an increase in rates. In most cases, this is something that happens annually.

Attained-age rated

This rating classes bases your premium on your “attained” age, the age you currently are when you buy the policy. Attained-age-rated policies generally are cheaper at age 65, but their prices increase automatically as you age. The following will illustrate a situation in which attained-age rating is used:

Jim Bailey is currently 67 years old and buys a Medigap policy, with a premium of $125. When he turns 68 years old, his premium will increase to $128. At 72, he will pay $142.

Other Considerations

Again, please note that in certain states, insurance companies are required by law to sell “issue-age” policies only. Georgia and Florida are examples of this. As a result, rates are generally higher but possibly more stable in the long run.

Also, you should always be aware of other variables that impact the rates. Some companies have gone to using a discount for signing up at age 65; however, the discount goes away each year as you get older. Although they may technically be able to classify themselves as community-rated, the premium has a built-in increase each year as you get older because of the expiration of the discount. This makes a policy like this no different from an attained-age policy for the life of the discount.

Which Rating Methodology for Medigap Policies is Best?

This should have given you a better understanding of how insurance companies rate their Medigap pol icies. Hopefully, with this knowledge you will be able to make an informed decision when it comes time for you to choose a Medigap plan.

icies. Hopefully, with this knowledge you will be able to make an informed decision when it comes time for you to choose a Medigap plan.

The bottom line is that the best Medigap plan is the one that gives you the best “deal” for the life of the policy at a coverage level you want. All the above types of rating classes have historically resulted in increases over time to account for inflation. There are unfortunately no guarantees as to the amount of each increase. Your best protection against any future rate increases is to select a company that has stability, an excellent reputation (is highly rated) and of course, the cost of the policy.

If you want a list of Medigap plans for your area or have specific questions, you can contact us online or call us at 877.506.3378.

Why Do Medigap Rates Vary So Much?

One minute, you’re talking to your friend in a different state who pays $100/mo for her Medigap rate, and the next minute, you’re being quoted $150/mo for the same exact plan!

We promise that agents and insurance carriers aren’t discriminating against you. They also don’t choose a random number and roll with it, even though it may seem that way sometimes.

While a gallon of milk is the same cost for you and your neighbor, Medigap rates vary wildly depending on several different factors.

Let’s break those down together. Skip this… I just want the list of Medigap rates by email

Get a List of Medigap Rates for Your Area

Complete the form to receive the information via email

[si-contact-form form=’9′] Information will be delivered by email, typically within a few minutes of the requestFirst Thing’s First – Plan Standardization

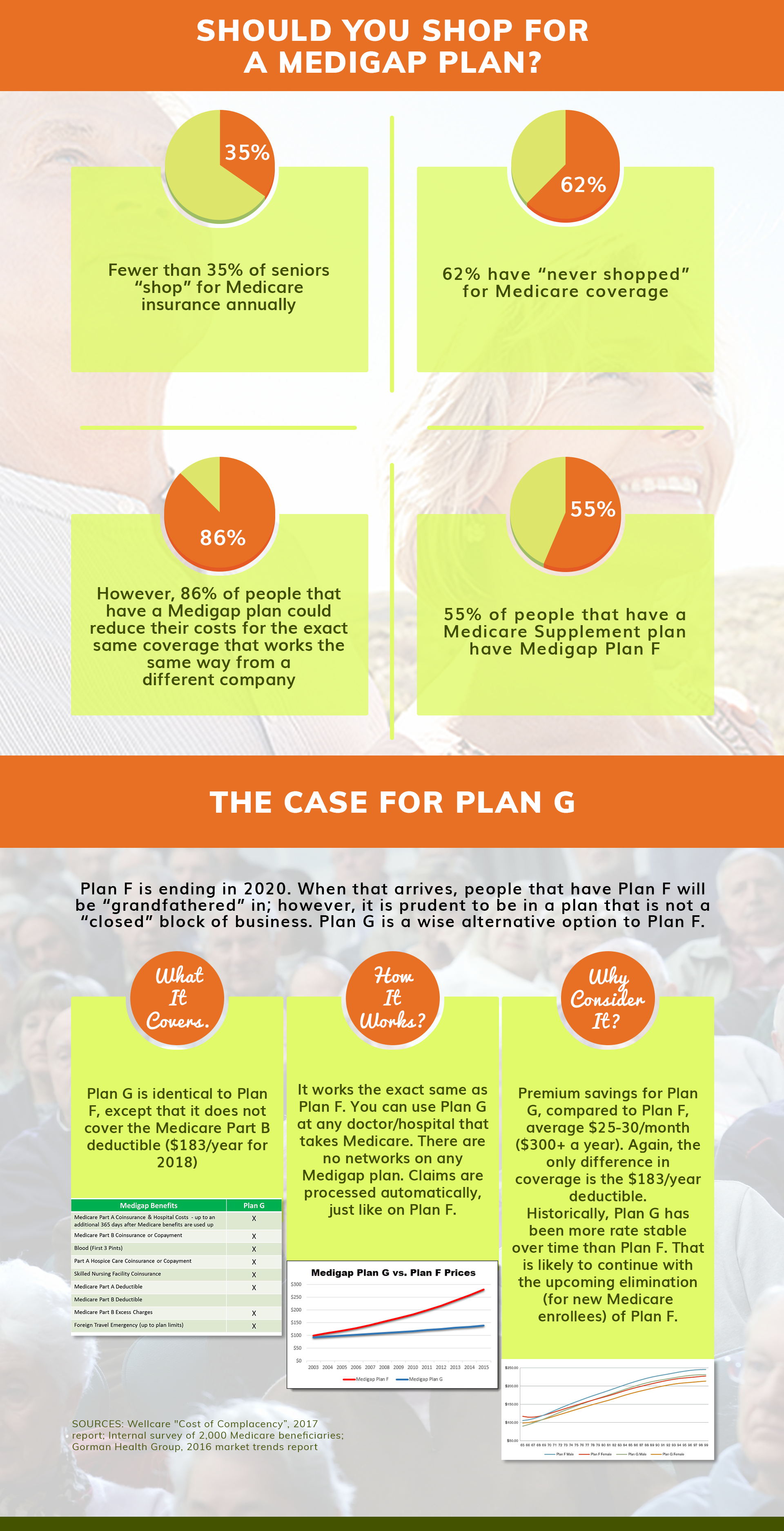

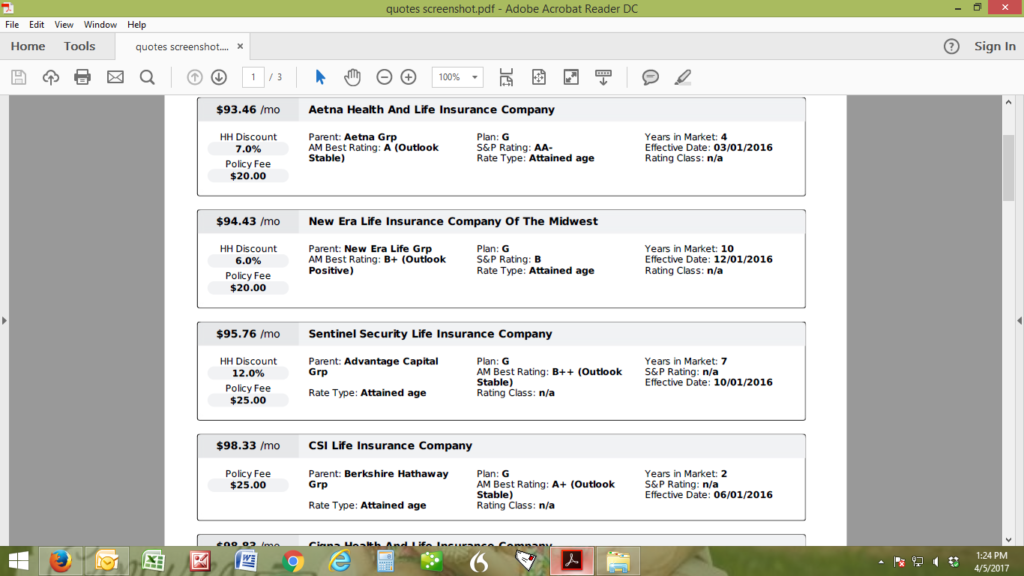

Medigap plans are standardized. So, your Plan G is going to give you the same coverage as your friend’s Plan G.

This is important to know, because prices do vary by carrier. We’ll get to the “why” part later, but knowing that the plans are the same across the board gives you the freedom to price shop, comparing “apples to apples”.

While price isn’t everything — you do want to consider the integrity of the company, its AM Best Rating, and its history — Medigap rates should be the primary basis for your decision.

The rest of this article will go over why price varies according to location, age, and carrier.

Location Determines Medigap Rates

Where you live will play a big role in how much your personal Medigap plan costs. The reason why can get a little messy and confusing, but here’s the gist: Each state has the liberty to make different legislation.

This means that Medigap rates will vary from state to state. Factors like availability, regulation of Medicare plans, and Medicare beneficiaries in different areas will change how the pricing is done.

Another big factor is that, in general, it’s hard to switch from one Medigap plan to another, especially if you’re health isn’t in tip-top shape. Some states have recognized this, and they’ve passed legislation to make it easier to switch.

States like California, Oregon, Maine, and Missouri have done this. This means that unhealthy people are switching onto different plans, which means those plans are bound to shoot up in price.

Prices vary a lot, from about $139/month in Hawaii to $226/month in New York for the same plan. And, actually, rates can even vary considerably by zip code within the same state. It’s always best to price check plans based on where you live — not by what the “average” might be.

Age Determines Medigap Rates

Medigap policies are priced based on three different models:

1) Attained-age pricing

3) Issue-age pricing

Attained-age means that every year, your Medigap premium goes up. Community-rated means that age does not affect your premiums. Issue-age means that your premium will be locked in when you purchase your plan. So, if you purchase a plan at age 70, you get the 70-year-old rate for life.

Now, with all of these models, premiums can still go up from factors like inflation and just general rate increases, but as you can see, age often does determine how much a plan will cost.

You’ll see how this all comes together — different states will allow different types of pricing models. For example, Florida and Georgia do not allow attained-age pricing. This adds a piece of complexity into the puzzle. The link between age and location (in relation to your Medigap rates) is often tied together.

Carrier Determines Medigap Rates

Like you read earlier, a Plan G is a Plan G. This is federally regulated, so you’re able to price shop different companies and know that the coverage is exactly the same.

So, if the coverage is the same, why would it be more expensive with another carrier?

Each company has their own set of health questions. Those companies choose who they want to accept based off of how you answer them. The companies that have harder health questions will offer a cheaper price, while the opposite is also true for the easier companies.

Another big factor is rate increases. If one company has to pay out a lot of claims, you’ll probably end up seeing a rate increase. This will vary wildly from carrier to carrier, and it all comes down to who they accept or decline.

Lastly, Medigap rates are just like anything else on the free market – companies decide how to set their premiums, based on which customers they want to attract (and from which geographic area) and what price point it takes to reach those customers.

How Much Will It Cost Me?

You can probably see now why it’s impossible to put a “pricing” page on the internet. We’d probably be getting a lot of calls complaining about inaccurate it is. Moreover, some companies don’t even allow their rates to be quoted online. Plus, rates can change on a month to month basis. So, a list of rates that you DO find is likely to be inaccurate (even on state department of insurance websites) and certain to be incomplete, which is why you typically have to request Medigap rates by email.

Price just varies so much based on where you live, how old you are, and which carrier you go with. That’s why you’ll find many different websites (including ours) that will ask you to request a quote.

It’s a very personalized service, and you can see why that’s the only real way to do it right.

Please note, though, that even if you do end up paying more than someone else, your coverage is the same. The same goes if you end up paying less. You don’t get less coverage — remember that every plan is standardized.

If you’re really interested in getting an idea of how much a Medigap plan would cost you in your specific location and for your specific age, you should contact an independent broker to provide a list of available options.

We can compare different companies and we’ll pinpoint your rate based on your own situation.

You can do that here: Medigap Quotes

If you have any questions about how rates are calculated, don’t hesitate to reach out to us!

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

Five Things You Must Know When You Are Turning 65

Turning 65 is a whirlwind.

You may be retiring or thinking about retiring soon, and you’re probably getting hounded with emails and mail about Medicare and what you should do about it.

If you’re trying to figure it all out on your own… well… you don’t have to.

Our agents are ready to give you a hand at absolutely no cost to you whenever you’re ready.

But, if you’re just starting to get a feel for your new responsibilities, here are 5 things that all 65ers need to know.

5. Enroll in Medicare Part A and Part B.

When you turn 65, Medicare is officially available to you. You’ve been paying into it for long enough, so why not reap its benefits?

Part A cover inpatient care, and it’s completely free. No monthly premium for you.

Part B covers outpatient care, and it’s monthly premium, as of 2017, is $134. Note: that cost is higher if you make more than $85,000 per year (or $170,000 per year as a household).

If you’re on group coverage, and you’re still working, you need to weigh your options. You can read more about that here: https://65medicare.org/should-you-keep-your-group-insurance-when-you-turn-65.

Here’s what your timeline looks like:

→ 3 months before you turn 65, your birthday month, and 3 months after you turn 65.

If you miss this 7-month window, you’re going to be hit with some late enrollment penalties.

Here’s how to sign up, straight from Medicare.gov:

- Apply online at Social Security. If you started your online application and have your re-entry number, you can go back to Social Security to finish your application.

- Visit your local Social Security office.

- Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778).

- If you worked for a railroad, call the RRB at 1-877-772-5772.

- Complete an Application for Enrollment in Part B (CMS-40B). Get this form and instructions in Spanish. Remember, you must already have Part A to apply for Part B.

You can choose to opt out of Medicare Part B if you want, but you should discuss it with your agent first.

4. Look into Medicare Part C (Medicare Advantage).

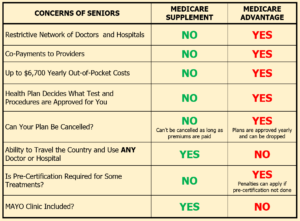

Medicare Advantage is an alternative to Medicare and Medigap plans. It often has a very low monthly premium, but it also comes with its downsides.

The first problem is the limited network. There are a lot of doctors that don’t accept Medicare Advantage. It could leave you with either no doctors in your area, or a doctor that’s not your favorite.

Also, the premium may look like a good sticker price, but there’s still hefty deductibles and co-pays. We’ve seen those range anywhere from $3,000-$7,000.

Medicare Advantage can be a good option for those in large cities. Large cities often have more doctors to choose from.

If you’re in a smaller city, you may not have any doctors, meaning you’ll have to drive a distance to see a doctor.

It’s always best to weigh your options (Read our Medicare Advantage vs. Medigap article), so don’t rule anything out until you check out your own situation and your own network of coverage.

3. Sign up for Medicare Part D.

Medicare Part D, also called a prescription drug plan, or PDP for short, helps a lot of people save money on drug costs.

The dilemma here is that many turning 65 aren’t on any prescriptions yet. Why then would you pay a monthly premium for drug coverage that you don’t need?

Great question, and here’s the answer: For every month you delay signing up for Part D, you receive a 1% penalty on the premium.

We realize that may sound a little confusing, so here’s an example.

If you had signed up for Part D when you turned 65, let’s say your monthly premium would’ve been $50.

For each month you delay signing up, your monthly premium goes up by $0.50. So, by the end of the year — 12 months later — your premium has gone up to $56. Now, you’re not paying that premium yet, but when you do sign up for Part D, that penalty will go into effect.

If you had signed up for Part D, your premium would’ve stayed at $50.

It’s often a choice that takes time to make. If you end up needing prescriptions and you don’t have a Part D plan in place… well, we all know how expensive prescriptions are. It’s a gamble — are you willing to take the risk? And the penalty?

2. Choose a Medigap plan.

Medicare does cover a good portion of your medical expenses, but you’re still left behind with a nice chunk of risk.

To put things simply, Medicare covers about 80% of your medical expenses. A Medigap plan picks up that other 20%. That’s a generalization, and it’s more complicated than that, but that’s the simple way of putting it.

To “fill in the gaps of Medicare,” many will buy a Medigap plan. This is also called a Medicare Supplement.

You can buy a policy of your choice up to 6 months after you enroll in Medicare Part B. After that — you guessed it — penalties.

One of our agents can help you choose a plan that fits your budget.

1. Consider long-term care insurance.

Long-term care insurance is a big decision to make, and it definitely shouldn’t be made in haste. However, as time goes on, your ability to even purchase it starts to decrease.

Long-term care is only available to those that can pass the rigorous health questions. As we get older, that becomes less likely, and some carriers even cap off the age you can apply right around 65.

Also, the other you get, the more expensive it gets. After the age of 65 or so, long-term care insurance starts to become very pricey, often more than many are willing to pay.

Long-term care itself is extremely expensive — it can be around $100,000 a year in many cases — so if you’re interested in getting some insurance coverage, you ought to start thinking about it now.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

Should You Keep Your Group Insurance When You Turn 65?

If you’re on group insurance currently, how do you know if you should switch to Medicare?

It can be a tough choice to make, and if you make the wrong one, it can end up costing you a lot of money and trouble.

Having a Group Insurance Plan AND Medicare

Having two types of insurance is somewhat complicated. In these scenarios, the “coordination of benefits” rules will decide who will pay what.

Here are some guidelines provided by Medicare.gov:

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn’t cover.

- The secondary payer (which may be Medicare) may not pay all the uncovered costs.

- If your employer insurance is the secondary payer, you may need to enroll in Medicare Part B before your insurance will pay.

What we find in these situations is that things get messy, and it’s often better to just choose one or the other.

But, how do you know if you should keep your group or make the move on over to Medicare?

Should I Keep My Group Insurance When I Turn 65?

We hate to skirt the issue here, but in all honesty, it depends on each individual situation. If we take a high-level overview of every client we’ve been able to help, it appears that switching to Medicare and adding on a Medigap plan can save most people a lot of money.

However, it completely depends on a variety of factors, such as whether your employer pays your insurance premiums and what the deductibles and copayments are.

Let’s say that your group plan costs $400 per month, your deductible is $1,500, and a regular office visit costs you $35.

On top of those costs, your coinsurance is usually around 20%.

Now, none of this really matters if your employer pays the $4000 premium, and you don’t go to the doctor much.

However, if you are paying that monthly premium, and you do go to the doctor often — or you worry that you may end up needing to — Medicare with a Medigap plan will probably save you a lot of money.

Switching to Medicare with a Medigap Plan

So, what do the costs look like when you switch from a group plan to Medicare?

Medicare Part A: $0.

Medicare Part B: $134.

Medigap Plan: Depends, but let’s say you have a Plan G which covers everything except the Part B deductible, which is $183. So, let’s say your monthly premium is $125 (which is actually high in most areas of the country).

Part D plan: Also depends on which prescriptions you have, but let’s say your premium is $40.

With your group plan, your expenses look like this:

Premium: $400 per month

Deductible: $1,500

Office copay: $35

Coinsurance: 20%

With Medicare + a Medigap plan, your expenses look like this:

Premium: $299 per month

Deductible: $183

Office copay: $0

Coinsurance: 0%

That obviously looks a lot better, doesn’t it?

Now, these numbers are just estimated figures, and they will vary wildly depending on where you live, what gender you are, your age, which carrier you choose, and so on. But this is the type of calculation that should be done when comparing these two options.

In order to figure out what your Medigap costs will be, you’ll need to get a Medigap quote. We can do that for you.

Group Insurance Plan Negatives

Group plans can be very convenient, but there are still some more factors to consider.

The first is that group plans have networks, and those networks will restrict which doctors you can go to. With Medicare, there are no networks. Medicare Advantage is another story, but Medicare with a Medigap plan will give you more freedom than a group plan.

The second is that group plans often have a really horrible deductible. Not always, but usually. We’ve even seen group insurance deductibles are high as $5,000+. With Medicare, that will never be the case. A Medigap plan will pick up that cost.

Coinsurance can be another wallet-drainer, and that’s another cost that a Medigap plan will take care of.

Finally, you have options with Medigap plans. If you get a rate increase, you can shop around and switch to a cheaper plan. Every Medigap plan is standardized by the federal government, so price shopping is really simple.

When to Make the Switch

The easy answer: talk to one of our agents and explain your individual situation.

The hard answer: it depends.

With this topic, there are so many footnotes and asterisks that it’s nearly impossible to give a straight answer.

The basic answers we can give you are that you should enroll in Medicare when you turn 65 — IF it’s looking like it’ll be cheaper than your group plan. An agent can help you make that determination.

If you’re past 65, you can switch to Medicare when you lose your group plan or when you know your group plan is going away.

How to Sign Up

Did Medicare+Medigap make the cut as the more financially prudent choice in your situation? Great!

You can apply for Medicare at your local Social Security office (Find a local SS office). To sign up for a Medigap plan, simply contact us.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.