Medigap Plan G is quickly becoming one of the more common options when it comes to Medigap plans. And often, Plan G is among the best “deals” financially.

With Plan F ending for new Medicare enrollees in 2020, many beneficiaries are looking at Medigap Plan G as a comprehensive coverage alternative. Even before that announcement in 2015, Plan G had shown itself to be a winner in terms of premiums, rate stability over time, and comprehensive coverage. Now, in 2025, it is the most commonly selected plan by far.

The foremost thing to remember when it comes to Medigap plans is that the plans are Federally-standardized. This just means that all of the companies provide the exact same coverage plans. Coverage comes from the Medigap coverage chart. So while rates can, and do, vary considerably, the benefits are always the same when it comes to Medigap plans. Likewise, the plans also work the same way, can be used the same places and pay claims on the same time schedule and amounts. So when it comes to comparing Medigap plans, you should compare on price and company reputation.

What Does Medigap Plan G Cover?

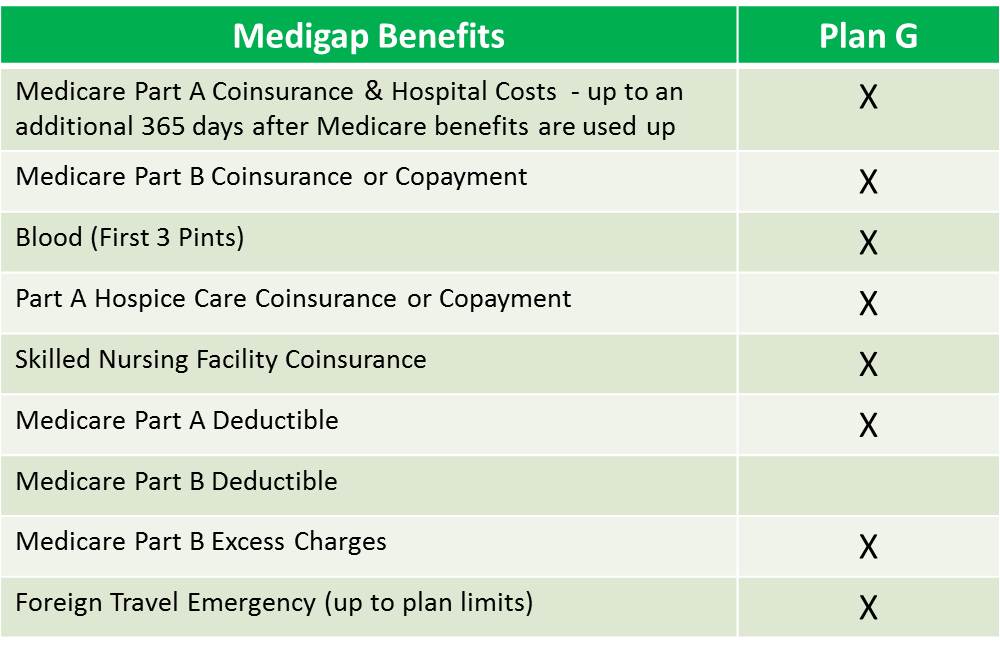

Let’s take a look at what Medigap Plan G covers. It is one of the more comprehensive Medigap plans and covers everything that Medicare does not cover with the exception of the Medicare Part B deductible, which is currently $257/year (2025). This is the doctor’s office deductible. So, typically, 1-2 doctor visits knock out the deductible. Regardless of whether you meet the deductible or not, premium savings are often great enough to make the plan a better deal anyway (more about this later).

So what does Plan G cover:

- Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

- Medicare Part B coinsurance or copayment

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B Excess charges

- Foreign travel emergency

It is an easier exercise to talk about what Plan G does not cover. That one thing is the Medicare Part B deductible ($257/year for 2025). All other charges are covered by Medigap Plan G and that deductible amount is your maximum out of pocket costs for the year.

How Does Medigap Plan G Work?

Medigap Plan G is a Federally-standardized Medigap plan. As such, it works just like other Medigap plans. All Medigap plans, regardless of what your insurance company is, can be used at ANY doctor/hospital that takes Medicare nationwide. There are no networks to stay within or typical PPO/HMO concerns.

Additionally, the claims are all handled automatically through the Medicare “crossover” system. This is Medicare’s system to coordinate the payments from the secondary insurance provider (your Medigap plan). It insures that the policyholder does not have to be involved in the claims process. Medicare-approved claims are paid automatically by the Medigap plan. There’s not an approve/deny claims process – if Medicare pays, the Medigap pays. If Medicare does not, the Medigap plan does not.

Is Medigap Plan G the Best Deal?

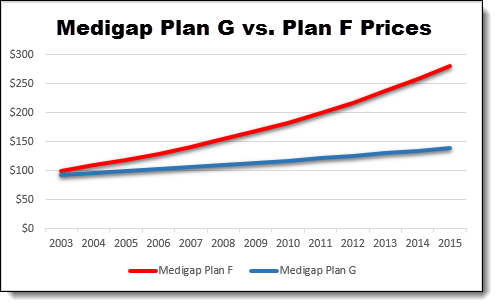

In recent years, many companies have considerably lowered their rates on Plan G. While some initially thought this may have been a “buying business” tactic that would result in later large increases, this has not borne itself out to this point with most companies. Plan G rates are among the most stable of any of the plans. There are several significant reasons for this.

First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage. In those situations, applicants can get a handful of the Medigap plans (including Plans A, C and F) on a “guaranteed issue” basis. So someone with pre-existing conditions that was losing their group coverage, would be eligible for Plan F but NOT Plan G. Over time, this leads to the Medigap Plan G policyholder “pool” being, on average, healthier and having fewer claims. In turn, this leads to fewer/smaller rate increases on ‘G’ as compared to other plans including Plan F. This is not theory, but rather, has shown itself to be accurate over the last 10 years with Medigap Plan G average annual increases being approximately 2% lower than Plan F average annual increases.

The second big advantage of Medigap Plan G is that it is often a better deal than other options. In comparison to Plan F rates, Plan G rates are typically $240-500/year lower. The Part B deductible, which is the only difference in ‘F’ and ‘G’, is currently $257/year (2025). So you can potentially save a few hundred dollars with ‘G’ (and have a more rate-stable plan) by paying this deductible.

One thing to keep in mind when comparing plans is that insurance agents are financially incentivized for your premium to be a higher. Because they receive a percentage-based compensation, the higher your premium is, the more money they make. Likewise, insurance companies obviously prefer you to be in higher-premium plans because they make more money! This is why you will find many of the “name brand” companies that only sell Medigap Plan F and NOT Medigap Plan G. What is a good deal for insurance agents and insurance companies is probably not a good deal for you.

Where Can I Use a Medigap Plan G?

Medigap Plan G is just like other Medigap plans – it can be used at any doctor or hospital that takes Medicare. This is true, regardless of which insurance company insures you under their Plan G – whether it is a “name brand” company or a smaller, more local insurer. When a doctor agrees to take Medicare, he or she is also agreeing to take any of the standardized Medigap plans.

One of the biggest advantages of the Medigap plans is their portability. These plans can be used across state lines and are accepted anywhere in the country that takes Medicare. This is one of the biggest differentiators of Medigap and Medicare Advantage. Advantage plans are network-based plans and are based on your county of residence. If you are traveling with that type of plan, you would be out of network in most cases, causing you to have larger out of pocket costs. By contrast, Medigap Plan G can be used anywhere nationwide that accepts Medicare.

What Companies Sell Medigap Plan G?

In recent years, with the growth in popularity of Medigap Plan G, more and more companies have begun to offer this plan. Then, with the recent announcement of the 2020 elimination of Plan F, Plan G is now be the most comprehensive plan offered (after 2020).

All of this has led to a very competitive marketplace for Plan G in most locations. For example, a survey of the marketplace in ten different states shows that there are 8 or more insurance companies within $10/month premium of the lowest Medigap Plan G premium (January 2025 rates).

Some of the larger companies that are competitively priced in many markets include Aetna, CIGNA, Mutual of Omaha, United Healthcare, and Transamerica. But aside from those larger, more well-known companies, there are also other lesser-known companies that offer Plan G (keep in mind that benefits, coverage, and the way plans work are all identical with all Plan G’s), including companies such as Bankers Fidelity, ACE, New Era, Manhattan Life, and others.

As always, when comparing Medigap plans, it is crucial to get a full comparison of Medigap Plan G rates for your area when you are choosing a plan. You should target the companies that are both competitively priced and highly rated when picking a Plan G. It is both unwise and unnecessary to pay “extra” for the same thing.

When Can I Sign Up for a Medigap Plan G?

The very best time to enroll in any Medigap plan, including Plan G, is during your initial open enrollment period. This period starts on the 1st day that you are both age 65 or older and enrolled in Medicare Part B. The “open enrollment” period lasts for 6 months.

Note that there is an annual election period that runs October 15-December 7 each year. Many Medicare beneficiaries, insurance agents and advertisers mistakenly call the “open enrollment” period. This period has nothing to do with Medigap Plan G or other Medigap plans – it is only for Part D prescription drug coverage and Medicare replacement plans like Medicare Advantage.

So, the best time to sign up for Medigap Plan G is when you turn 65 or start Medicare Part B for the first time. After that, you can enroll in a Medigap plan or change Medigap plans at ANY time. However, this does require, in most states, answering some medical questions and getting “approved”. So it is wise to do it when you are first eligible.

There are some situations that are considered “guaranteed issue” situations, during which you do not have to answer medical questions to enroll in a Medigap plan. Some of these situations include losing group coverage or losing Advantage plan coverage due to a move. During those “guaranteed issue” times, you can get some plans on a “guaranteed issue” basis. But as discussed above, the plans available on “guaranteed issue” do not include Plan G.

If you want more information about Medigap Plan G or a list of companies and rates for your area, please feel free to contact us for Medigap Plan G quotes or call us at 877.506.3378.