Medigap Plan G rates can vary widely, depending on  several variables including what part of the country you are in, your age, and your gender (Get Plan G pricing in your area by email).

several variables including what part of the country you are in, your age, and your gender (Get Plan G pricing in your area by email).

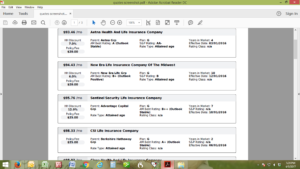

The short answer for “how much does Plan G cost” is “it depends on where you live, how old you are and what gender you are”. In most areas of the country, Plan G prices start at around $90-110/month. However, some states that are lower than that and some that are much, much higher. To give you an idea, here are a few examples of current (April 2025) Plan G (or Medicare G) prices in different parts of the country.

Important note: The rates below are for example purposes only. Rates can change monthly and are dependent on a handful of factors. What we do is provide all Plan G rates and ratings and help Medicare beneficiaries compare and sign up for the best Plan G deal in their area. Don’t trust other websites that require you to provide your phone number just to obtain the rates. For a list of current Plan G rates in your area delivered by email, click here: Medigap Plan G Rates by Email

Get a List of Plan G Rates for Your Zip Code

Complete the form to receive the information via email

[si-contact-form form=’9′] I hate spam too, so I will never send any to you!The Plan G rates shown below are for a 65-year old, non-smoking, female, and they are the lowest current rates in that respective area (every insurance company charges different prices):

EXAMPLE 1 (ALL OF NC): Medigap Plan G Rates start at $85/month.

EXAMPLE 2 (PANHANDLE FL): $164/month

EXAMPLE 3 (SOUTHERN CA): $138/month

EXAMPLE 4 (WESTERN PA): $117/month

EXAMPLE 5 (DALLAS TX): $103/month

EXAMPLE 6 (CENTRAL INDIANA): $88/month

EXAMPLE 7 (DENVER CO): $116/month

EXAMPLE 8 (UPSTATE SC): $86/month

EXAMPLE 9 (IOWA): $84/month

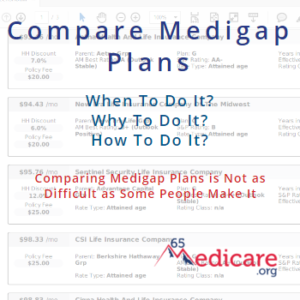

In addition, Medigap Plan G prices can vary within the same geographical area by as much as $100/month with different insurance companies, although the coverage is completely identical. With Medicare Supplement plans, the companies are allowed to determine what they charge for their plans, although the coverage is Federally-standardized. In other words, you can end up paying much, much more for the exact same coverage that works the same way. If you have been with the same Medigap Plan G since you started on Medicare, it is almost certain that you can reduce your costs for equivalent coverage that works the exact same way.

Click here to receive a list of Medigap Plan G Rates by Email Complete the form to receive the information via email Get a List of Plan G Rates for Your Zip Code

How Can I Get Medicare Supplement Plan G Prices?

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state – usually around 30-35 companies. From there, you can contact each insurance company’s call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employer’s bottom line. [Click here to use us to get Medicare Plan G prices]

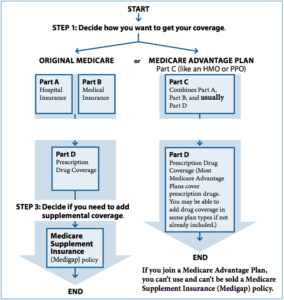

What Does Plan G Cover?

If you are already looking into Medicare Supplement Plan G prices, you likely are already familiar with what Plan G covers. But if not, here’s a brief overview.

First and foremost, here is the Medigap standardized plans chart – this chart shows the plans that all insurance companies are allowed to offer. If a company is going to sell Medicare Supplement plans, it has to be one or more of the plans listed on this chart.

Plan G, in particular, covers all the “gaps” in Medicare, with the one exception of the Medicare Part B deductible. This deductible is currently (2025) $257/year. So, if you have a Plan G, the plan will pay the Medicare co-pays, coinsurance, and the Medicare Part A deductible – your only out-of-pocket costs would be the Medicare Part B deductible amount, currently $257/year.

How Do I Sign Up for a Plan G?

So, once you understand what Plan G covers and have obtained the Medicare Supplement Plan G prices, you can move to the next step of comparing the specific options in your area and enrolling in a plan. Although this is the most important step, it is also the easiest one to do.

The days of the 20+ page insurance application are long gone (unless you like that sort of thing). Most insurance companies now offer online applications that are streamlined, easy to do and painless. In particular, if you are turning 65, you in your initial open enrollment period. During this time period, you do not have to answer any medical questions or “qualify” to obtain a plan.

If you are already working with an independent broker, that broker can provide you the application or the online link to your customized application so you can enroll. If you are not working with a broker yet, you can contact the specific company you want to sign up for and they will (in most cases) direct you to a broker that can enroll you. If you want our service and assistance enrolling, find out what our clients say/why you should work with us and contact us to get started.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

oincides with your enrollment into Medicare Part B and the contingency that you be 65 or older.

oincides with your enrollment into Medicare Part B and the contingency that you be 65 or older.

a plan outside of these periods. What this means, in practice, is that you have to answer medical questions on an application and be “approved” to get a plan. These questions vary by state and company, so the only way to see if you would qualify is to contact a broker for guidance or contact each insurance company in your state to find out if you are eligible.

a plan outside of these periods. What this means, in practice, is that you have to answer medical questions on an application and be “approved” to get a plan. These questions vary by state and company, so the only way to see if you would qualify is to contact a broker for guidance or contact each insurance company in your state to find out if you are eligible.