Medigap Plan N is a relatively newer Medigap plan. It originated when the plans were re-standardized in 2010. That said, it has definitely picked up traction as one of the increasingly popular options among the Medigap plans. Plan N is a plan that offers a lower premium in exchange for some cost-sharing (i.e. out of pocket costs for the insured).

Medigap Plan N is a relatively newer Medigap plan. It originated when the plans were re-standardized in 2010. That said, it has definitely picked up traction as one of the increasingly popular options among the Medigap plans. Plan N is a plan that offers a lower premium in exchange for some cost-sharing (i.e. out of pocket costs for the insured).

Just like with any of the Medigap plans, it is important to remember the basics with Medigap insurance. First and foremost, the plans are Federally-standardized. So, a Plan N with one company will be identical to a Plan N with another company. They are not allowed to add/take away benefits from the benefits set forth on the Medigap coverage chart. Moreover, in addition to coverage being standardized, claims payments are as well. They are handled through the automated Medicare “crossover” system. Lastly, all doctors/hospitals that take Medicare will take any Medigap plan. There are no networks for Medigap plans.

So, what does Plan N cover, how does it work and is it the best Medigap plan for you?

What Does Medigap Plan N Cover?

First, let’s take a look at what Medigap Plan N covers. It is typically one of the lower-premium Medigap options, since it does have some cost-sharing. But it can definitely be a good deal in some areas and situations.

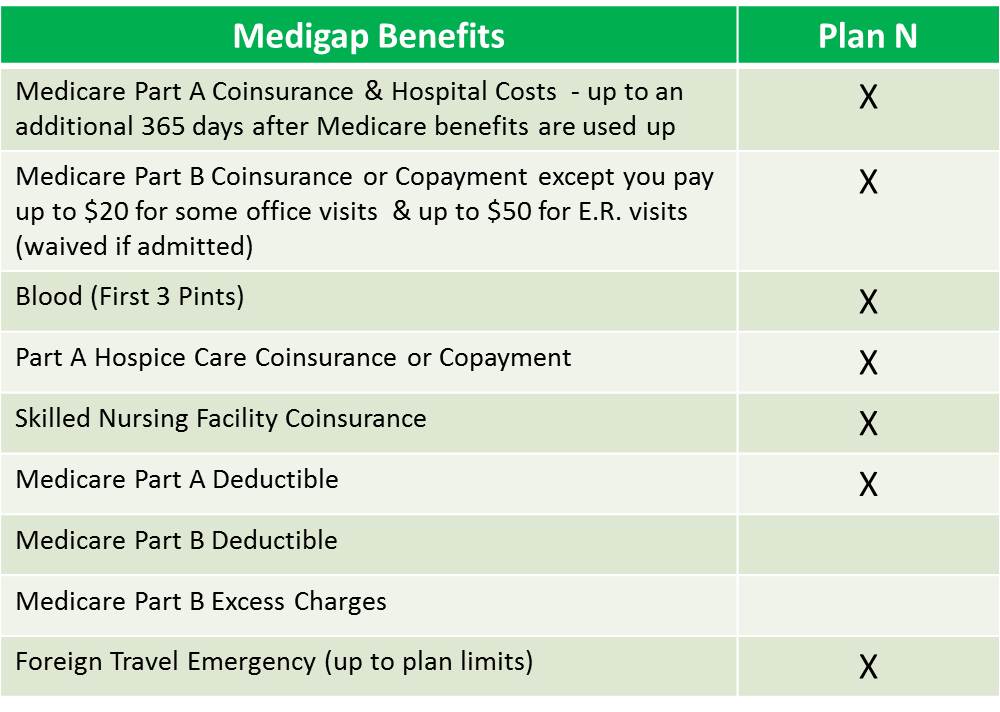

It is probably easier to talk about it from a standpoint of what does Plan N NOT cover. It does not cover the Medicare Part B deductible (currently $257/year for 2025). Also, it does not cover the Part B coinsurance in full – if you have Plan N, you are responsible for co-pays of up to $20 per doctor visit and $50 at the emergency room. Lastly, it does not cover the Medicare Part B Excess charges. Part B Excess charges are when a doctor does not accept the Medicare payment schedule as payment in full. They are allowed to charge up to 15% above that Medicare payment schedule. There are few states where this is prohibited (more about this later).

So what does Plan N cover:

- Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergency

So, with Plan N, there is more uncertainty as far as your total out of pocket costs than there would on other plans, such as Plan G or Plan F. That said, premiums on Plan N are typically $15-30/month lower than premiums on Plan G and can be as much as $50/month lower than Plan F premiums. So if you are not going to the doctor much, it may make sense for you.

Get a List of Plan N's for Your Zip Code

Complete the form to receive the information via email

[si-contact-form form=’9′] Information is delivered by email, typically within a few minutes of your requestHow Does Medigap Plan N Work?

Medigap Plan N is a standardized Medigap plan. As such, it works just like Plan F, Plan G and the other plans. All of the claims are automated and paid through the Medicare “crossover” system. There’s no involvement by the insured in the claims process except in rare cases.

Thee is more cost-sharing with Plan N, though, obviously. On Medigap Plan N, you would meet the deductible first. The way this typically works is that you go to the doctor and the doctor files the claim to Medicare. Once Medicare responds that you have not met the deductible, the doctor’s office will bill you for up to $257 in a calendar year. If you have met the deductible, they will bill you for the co-pay amount. In some cases, once you are established, they will collect the co-pay from you at the time of service, but typically this is done after the claim has been filed to Medicare.

You can, of course, go to any doctor/hospital nationwide if you have Plan N. As long as a doctor accepts Medicare, they will also accept your Medigap plan.

Is Medigap Plan N a Good Deal for You?

Plan N can be a particularly good option for those in good health or those that do not go to the doctor much. You can look at the premium savings you would receive by going with Plan N, subtract out the deductible and add in as many co-pays as you would have in an average year. The only variable is the Part B Excess charges. You can usually call your primary physician or other physicians you see regularly to find out if they accept Medicare “assignment”. If they do not, that means that they can charge these excess charges. So that’s a good idea if you are considering Plan N.

One additional consideration that many people do not realize is that you have to ‘qualify medically’ to change Medigap plans after your initial turning 65 open enrollment period. Contrary to popular misconception, there is not an annual enrollment period that allows you to change plans. You can change Medigap plans at any time, but you have to answer medical questions and qualify to do so. This is important to understand because, if you choose Medigap Plan N, you should feel comfortable with it long-term. If your health changes, it’s possible you would not be eligible to switch to one of the other plans.

There are many companies that are now offering this plan as it has become a viable alternative for some people. It is advisable to compare costs extensively with a broker or by calling each company, as costs can vary as much as 50% for the exact same coverage.

If you have any questions about this information or would like to speak to someone, contact us (form to the right on this page) or call us at 877.506.3378.