Medicare and Medigap insurance comprise a sound financial plan for someone over age 65. Medicare works as the primary coverage, with the Medigap plan (sometimes called a Medicare Supplement) filling in the gaps in Medicare. But, how exactly do Medicare and Medigap work together? There are four main things you need to know.

FACT 1: Medicare is Primary to Medigap Coverage

Once you hit 65 or start on Medicare, Medicare will be your primary coverage. With Medicare as primary, the Medigap plan backs it up as a secondary payer. Medicare pays, in most cases, 80% of the Medicare-approved costs (after the Medicare deductibles), and the Medigap plan pays, with most plans, the other 20% and some combination of the deductibles.

Medigap Plan F pays both of the Medicare deductibles and the remaining 20%, thereby filling in all the “ gaps” in Medicare and being full coverage. Plan G which is the next step down, and usually is the best deal, pays all but the Medicare Part B deductible, which is $198/year (for 2020). NOTE: For people who were first eligible for Medicare after 1/1/2020, Plan F is no longer available.

gaps” in Medicare and being full coverage. Plan G which is the next step down, and usually is the best deal, pays all but the Medicare Part B deductible, which is $198/year (for 2020). NOTE: For people who were first eligible for Medicare after 1/1/2020, Plan F is no longer available.

The way it works is that a doctor’s office files a claim to Medicare first, which pays that claim electronically. After Medicare pays, the Medigap plan pays as a secondary payer, after receiving the claim through the Medicare “crossover” system (see Fact #4 below)

The only exception to Medicare being primary coverage would be if you are still covered by an employer/group plan from a large employer – if the employer has more than 20 employees, the group plan generally pays first (source: Medicare.gov “Who Pays First“). The other exception to Medicare being primary coverage would be if you choose to opt off of “traditional” Medicare and get a Medicare Advantage plan. These plans take the place of Medicare and are essentially a privatized form of Medicare. Medicare does not pay any claims or provide any coverage if you have a Medicare Advantage plan.

I’ve heard enough… Email me the list of Medigap options with rates and ratings for my area

Get a List of Medigap Plans for Your Zip Code

Complete the form to receive the information via email

[si-contact-form form=’9′] Information will be delivered by email, typically within a few minutes of the requestFACT 2: Medicare and Medigap Are Designed to Work Together

Medicare and Medigap plans work together seamlessly. One the major concerns that we address in people turning 65 is how the Federal government health program could possibly work well together with a private insurance company’s individual health insurance policy. Although we certainly recognize the root of this concern, the two coordinate benefits and work perfectly together.

The following is an example of how this works:

- Medicare beneficiary, Bob, goes to the doctor’s office for a routine follow-up visit.

- Bob takes both his red, white and blue Medicare card in addition to his Medigap insurance card from ‘X’ insurance company.

- After seeing the doctor, Bob presents both cards to the doctor’s office representative.

- The doctor’s office gives the visit a Medicare code and files the claim electronically to Medicare. (Bob heads out for a nice, relaxing dinner with his wife)

- Medicare receives and pays the claim on a set, pre-determined time schedule and in a set, pre-determined amount (amount can vary by location). (Bob is on a week-long cruise with his children and grandchildren)

- Simultaneously, Medicare coordinates a payment from the secondary payer, Medigap, through the Medicare “crossover” system. (Bob returns from the cruise and starts working on his vegetable garden daily in between reading, exercising and meals with friends)

- Both Medicare and Bob’s Medigap company send him a statement, an “Explanation of Benefits”, showing what they paid and on what date they paid it. Bob smiles, files it, and is finished with it.

As you can see, the big thing that these steps have in common is Bob’s lack of involvement in them. Medicare and Medigap plans require no claims involvement from the beneficiary. They are designed to, and do, work together.

FACT 3: Medicare and Medigap Do Not Have Specific Networks

Neither Medicare nor Medigap plans have any specific networks that you must use. Medicare is a fee-for-service plan – in other words, it is not a  PPO or an HMO which requires adherence to a certain, predetermined network of doctors/hospitals.

PPO or an HMO which requires adherence to a certain, predetermined network of doctors/hospitals.

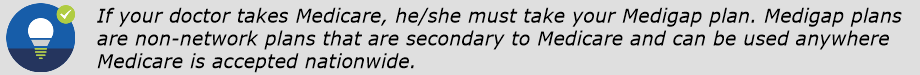

Most doctors and medical facilities do, of course, accept Medicare. Most importantly, anywhere that Medicare is accepted, your Medigap plan will also be accepted. As the primary coverage, Medicare determines where you can use your plans. In other words, if you go to a doctor who does not accept Medicare, or file to Medicare, your Medigap plan (regardless of what company it is with) will be useless.

The key, as a Medicare beneficiary, is seeing if your doctor/hospital, or any doctor/hospital you wish to use, accepts Medicare. If it accepts Medicare, then it is required to accept any Medigap company you choose (Does My Doctor Accept Medigap?).

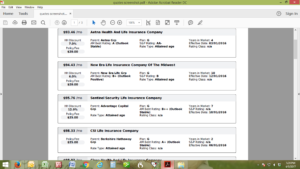

Many people that we work with make the mistake of choosing a Medigap company based on what they perceive to be a broader name recognition or acceptance. And, that is just not a good variable to consider when it comes to Medigap companies. On the contrary, often the higher name recognition companies charge a higher premium (because they can) for the exact same coverage. Doctor acceptance with Medicare and Medigap is identical from company to company.

FACT 4: Medicare and Medigap Coordinate Claims through the “Crossover” System

As previously discussed, Medicare and Medigap plans coordinate their claims payments through the Medicare “crossover” system. This system was created to simplify and streamline the claims payments process for Medicare and Medigap policies.

The way that the “crossover” system works is that Medicare sends claims information to the secondary payer (the Medigap company) and, essentially, coordinates the payment on behalf of the provider. This means that providers have very limited actual interaction with/contact with the secondary insurance, or Medigap policies. Providers deal, primarily, with Medicare, and the Medigap company pays claims electronically through the “crossover”.

I’ve heard enough… Email me the list of Medigap options with rates and ratings for my area

Get a List of Medigap Plans for Your Zip Code

Complete the form to receive the information via email

[si-contact-form form=’9′] Information will be delivered by email, typically within a few minutes of the requestSummary: How Do Medicare and Medigap Work Together?

Weekly, we talk to new clients who are astounded at how “easy” Medicare and Medigap insurance are. Most are familiar with the intricacies and hassles associated with “under-65” insurance, or even group insurance. With Medicare and Medigap plans, the plans are designed to work together, do work together seamlessly and pay claims automatically through the “crossover” system.

_____________________

65Medicare.org is a leading, independent Medicare insurance  agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

agency for people turning 65 and going on Medicare. We have worked with 10,000+ Medicare-eligible individuals over the last 10+ years, assisting with understanding and comparing the plans. You can get a list of Medigap quotes in your area. Or, if you have any questions about this information, you can contact us online or call us at 877.506.3378.

th and taxes. Well, today’s the day – tax day. Surely you haven’t waited until the very last day to file your taxes! A recent study showed that 12+ million taxpayers file for extensions each year, so maybe you haven’t filed yet after all. If not, and if you are cruising the Internet instead of working on them, we have the answer to an oft-asked question – are Medigap premiums tax-deductible?

th and taxes. Well, today’s the day – tax day. Surely you haven’t waited until the very last day to file your taxes! A recent study showed that 12+ million taxpayers file for extensions each year, so maybe you haven’t filed yet after all. If not, and if you are cruising the Internet instead of working on them, we have the answer to an oft-asked question – are Medigap premiums tax-deductible?