IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes.

How Does IRMAA Work?

IRMAA is an increased premium that some Medicare beneficiaries pay based on their income. This is Social Security’s pamphlet on this topic: https://www.ssa.gov/pubs/EN-05-10536.pdf.

IRMAA affects less than 5% of people with Medicare, but those it does affect are often surprised or unclear about how it works. For the part of the population that does not pay the higher premium amounts, Medicare pays approximately 75% of the cost of the Medicare Part B premium. The beneficiary is left with approximately 25% of the premium – $174.70/month in 2024.

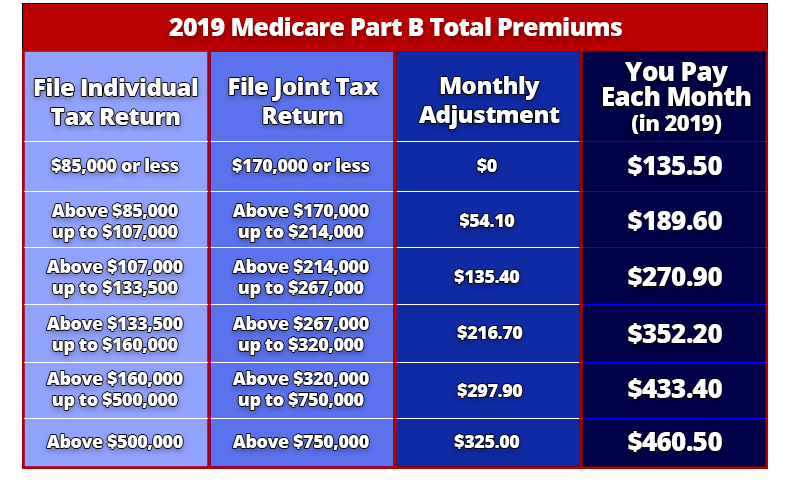

For people with higher incomes, you pay a higher percentage of the total – 35, 50, 65 or 80 percent – based on where you fall on Medicare’s income-related monthly adjustment amount scale (see below).

Likewise, you pay a higher Medicare Part D IRMAA premium if you fall into one of the higher income categories. The higher premium amount is applied regardless of which company you choose for your Part D plan. The IRMAA is applied on top of the premium that you would normally be paying for Part D.

Who Pays IRMAA?

Social Security uses the most recent tax return provided by the IRS. This means that the IRMAA determination ends up being based on a tax return from a couple of years ago. For example, the 2020 IRMAA determination is based on 2018 tax return.

The number used is the Modified Adjusted Gross Income (MAGI) and there is a sliding scale used. The sliding scale currently starts at $85,000 for individual income and $170,000 for married filing jointly income.

Here is the complete chart for IRMAA for Medicare Part B:

For Part D, the IRMAA amounts work similarly and are added on top of whatever your Part D premium is. Here is the chart that shows how IRMAA works for Part D:

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-related monthly adjustment amount |

| Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 |

| Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $12.90 |

| Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $33.30 |

| Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $53.80 |

| Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $74.20 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $81.00 |

How Can I Appeal IRMAA?

You do have rights if you don’t believe you should be subject to IRMAA Medicare amounts or wish to appeal the decision. Some of the instances that may lead to this are: you married, divorced or became widowed, you stopped work or reduced your hours, you lost an income-producing property, etc.

If you feel that one of these situations applies to you, you should contact Social Security to appeal your IRMAA determination. You will need to have appropriate documentation on whichever situation applies to you. There is no guarantee that Social Security will reverse your higher-premium determination, but it is certainly worth a try if one of these situations does apply. We have had clients who have had success in getting IRMAA appealed, reversed or adjusted.

To start the appeal process, you would go to Social Security’s website or call them at 800.772.1213.

Get a List of Medicare Supplement Prices and Ratings for Your Zip Code

Complete the form to receive the information via email

Ways to Reduce Your Medicare Costs in Other Places

If you have recently found out that you are going to be subject to paying IRMAA with Medicare, you may want to consider looking at reducing your other Medicare-related costs to offset the IRMAA amounts.

One of the biggest/easiest ways to do this is with your Medicare Supplement and Part D insurance. A 2016 study found that 98% of people were paying more than the best market rate for their Medicare Supplement insurance, although the plans all cover the same things and work the same way. As a brokerage that “shops” the best rates available, we typically help clients save anywhere from $300/year to $1500+/year, depending on how long you’ve had your plan and what company you have. You can get quotes by email here.

If you want information about this, have questions about the Medicare income-related monthly adjustment amount, or anything else related to your transition to Medicare, feel free to contact us here or call 877.506.3378.